Diving into Kansas City Southern’s Week 25 Intermodal Data

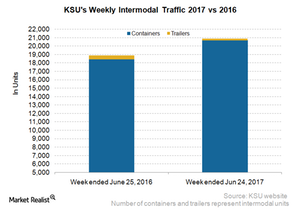

Kansas City Southern’s (KSU) total intermodal traffic in terms of containers and trailers rose 10.6% in the week ended June 24, 2017.

July 6 2017, Updated 9:07 a.m. ET

KSU’s intermodal traffic

Kansas City Southern’s (KSU) total intermodal traffic in terms of containers and trailers rose 10.6% in the week ended June 24, 2017. The company hauled nearly 22,000 railcars, compared to ~19,000 railcars in the week ended June 25, 2016.

Its containers saw a volume rise, unlike its trailers, which reported a sharp 53.4% fall in traffic in week 25. Its container volumes rose 12.2% on a YoY (year-over-year) basis to ~21,000 units, compared to nearly 19,000 units in the 25th week of 2016.

The company’s intermodal volumes rose along the same lines as US and Mexican railroad companies’ volumes in the reported week.

KSU’s intermodal business in 2017

Kansas City Southern reported a 2% fall in its intermodal revenue and a 1% fall in its volumes in 1Q17. The company’s 2Q17 intermodal volumes were lower year-over-year. KSU’s cross-border intermodal service with BNSF Railway (BRK-B) is expected to lift its volumes in the future. Its new APM Terminal could also push its intermodal volumes in 2H17.

However, trucking competition and Mexican currency downsides could cast a shadow over the company’s intermodal volume growth in 2H17. KSU’s Mexican subsidiary, Kansas City Southern de México (or KCSM), faces heavy competition from truck carriers. KCSM’s intermodal business rivals those of Trinity Logistics, Landstar System (LSTR), and ByExpress Logistics.

ETF investments

If you want to invest in transportation stocks, you may want to consider investing in the Guggenheim S&P 500 Equal Weight ETF (RSP). This ETF includes all US-originated Class I railroad companies (UNP) in its portfolio holdings.

Keep reading for an update on Canadian National’s (CNI) freight traffic in week 25.