Ashford Hospitality Trust’s Dividend Woes

Ashford Hospitality Trust (AHT) didn’t declare a dividend between September 15, 2008, and February 24, 2011.

July 26 2017, Published 12:10 p.m. ET

Ashford Hospitality Trust’s dividend structure

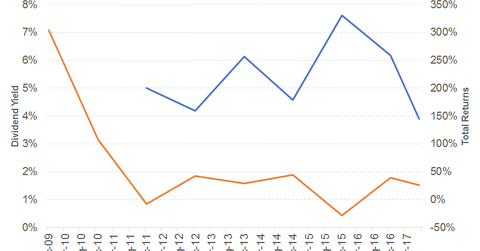

Ashford Hospitality Trust (AHT) has declared dividends despite its negative earnings in 2016 and 1Q17. AHT didn’t declare a dividend between September 15, 2008, and February 24, 2011. The dividend rate per share has remained constant since 2013.

Ashford Hospitality Trust recorded an average dividend yield of 5.6% and an average total return of 19.8% between 2011 and 2016 by the quarterly dividend payer. It has recorded a dividend yield of 3.9% and total returns of 26% on a year-to-date (or YTD) basis.

Fundamentals

AHT is an investor in the hospitality industry in upscale, full-service hotels and at every level of the capital structure, mainly within the US. The REIT has recorded growth of 12% and 4% in its 2016 and 1Q17 (versus 4Q16) revenues.

AHT’s 2016 EPS (earnings per share) ended in the red zone due to its negative operating income. Its 1Q17 revenues recorded a 4% decline compared to 1Q16, driven by lower contributions from rooms and food and beverages.

AHT’s 1Q17 revenues have grown compared to 4Q16. Its 4Q16 EPS was the lowest, followed by 1Q17 and 1Q16, driven by lower operating income and other losses and expenses.

AHT recorded negative growth in its FFO (funds from operations) in 2014 and 2016. The growth rate dipped in 2016 after a remarkable 2015. AHT’s dividend yield of 7.8% compares to a sector average of 5.4%.