Analyzing Weatherford International’s 2Q17 Performance

In 1H17, Weatherford’s revenues fell 8%—compared to 1H16. It managed to lower its net losses significantly during this period.

Nov. 20 2020, Updated 11:48 a.m. ET

Weatherford’s segment-wise performance

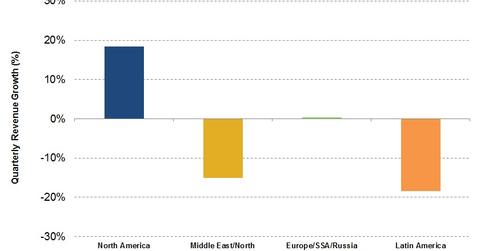

Revenues from Weatherford International’s (WFT) Latin America region fell the most (18.5% fall) from 2Q16 to 2Q17. On the other hand, Weatherford’s North America region saw strong revenue growth (18.5% rise) during the same period. In 2Q17, Schlumberger’s (SLB) North America revenues rose 18%—compared to 1Q17. To learn about Schlumberger’s 2Q17 earnings, read Why Schlumberger’s 2Q17 Earnings Beat Estimates. Weatherford International accounts for 0.31% of the ProShares Ultra Oil & Gas ETF (DIG). DIG fell 8% in the past year—compared to a 25% decrease in Weatherford’s stock price during the same period.

Operating income-wise, Weatherford’s North America region turned to $2 million profit in 2Q17—compared to an operating loss of $101 million the previous year. In contrast, Weatherford’s Latin America operations witnessed an operating loss of $35 million in 2Q17—compared to a small profit margin in 2Q16.

Positive factors in 2Q17

- nearly a 14% higher North America rig count in 2Q17, compared to 1Q17, had a positive impact on Weatherford’s drilling and completion product sales

- lower loss in Weatherford’s pressure pumping following the shut-down of operations in 4Q16

- savings from cost-cutting measures taken by Weatherford’s management in past quarters

- upstream activity increased in Argentina

- improved rig utilization and lower cost structure in the Land Drilling Rigs segment

Negative factors in 2Q17

- a negative effect from a change in accounting for Venezuela’s revenue

- a decrease in Secure Drilling product sales in Europe

How did Weatherford do in 1H17?

In 1H17, Weatherford’s revenues fell 8%—compared to 1H16. It managed to lower its net losses significantly during this period. In 1H17, Weatherford’s net loss was $619 million—compared to a net loss of $1.06 billion in 1H16.

Next, we’ll discuss Weatherford International’s returns.