Analyzing Schlumberger’s Growth Drivers in 2Q17

Schlumberger’s (SLB) Production segment witnessed the highest revenue growth (17.6% rise) in 2Q17 over 2Q16.

July 24 2017, Updated 4:06 p.m. ET

Schlumberger’s growth by segment

Schlumberger’s (SLB) Production segment witnessed the highest revenue growth (17.6% rise) in 2Q17 over 2Q16, followed by Reservoir Characterization (11.0% rise) and Production (3.6% rise). SLB’s Cameron product group, on the other hand, saw a fall of 17.0% in revenue for 2Q17 over a year ago. SLB makes up 6.4% of the ProShares Ultra Oil & Gas (DIG), which fell 15.0% in the past year compared to a fall of 18.0% in SLB stock.

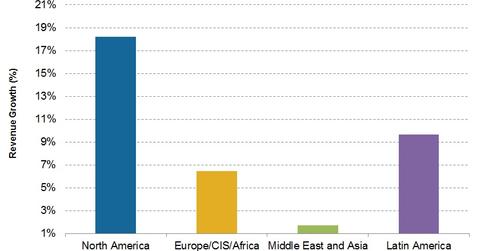

As for geography, Schlumberger’s revenue growth from North America was the highest in 2Q17 compared to a rise of ~18.0% in 1Q17, while its revenue growth in the Middle East and Asia region was considerably moderate (1.2% rise) during the same period.

Schlumberger’s segment margin analysis

The Reservoir Characterization group’s 2Q17 operating income margin (operating income as a percentage of revenue) remained unchanged at 17.0% over a year ago. The Production group (9.0% compared to 4.0%) and the Drilling group (14.0% compared to 8.0%) both experienced operating margin improvement from 2Q16 to 2Q17.

Schlumberger’s growth drivers: Positives in 2Q17

- accelerated completion activity in North America, driven by strong fracking and a higher rig count

- better pricing for products and services as US onshore revenue exceeded rig count growth

- change in rig design and longer laterals leading to higher demand for SLB’s rotary steerable systems and drill bit technologies

- strong performance in the Mexico, Russia, and CIS (Commonwealth of Independent States) region and increased upstream activity in the North Sea in Europe

Negative factors affecting SLB’s 2Q17 results

- lower offshore revenue due to pricing pressure in the Gulf of Mexico

- spring break-up in Western Canada, which slowed down rig-related work

- weak upstream activity in Brazil and Venezuela

- lower production from Ecuador’s Shushufindi project, which affected the Schlumberger Production Management (or SPM) system

- lower revenue from Kuwait following a WesternGeco land seismic acquisition completion

- lower revenue from India due to monsoons negatively affecting rig activity

Next, let’s take a look at Schlumberger’s returns.