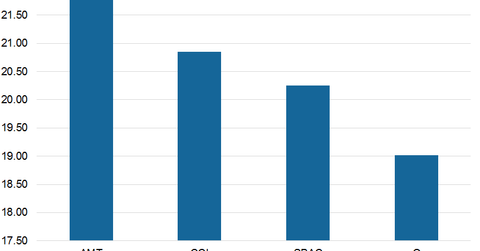

American Tower’s Place among Peers after 2Q17

AMT’s current price-to-FFO multiple stands at ~22.1x. After 2Q17, American Tower offers a next-12-month dividend yield of 1.9%.

Aug. 2 2017, Updated 9:07 a.m. ET

Price-to-FFO multiple

To evaluate American Tower’s performance in 2Q17, we’ll use the price-to-FFO (funds from operation) multiple, which is one of the most widely used valuation multiples for REITs (real estate investment trusts). This multiple carries the same implication as the PE (price-to-earnings) ratio, which we often use for companies in other industries.

Peer group price-to-FFO multiple

AMT’s current price-to-FFO multiple stands at ~22.1x. The company reported robust top-line and bottom-line results for 2Q17. High demand for the AMT’s mobile tower assets led to solid organic tenant billing growth and drove higher-than-expected results during the quarter.

By comparison, Crown Castle International (CCI), Realty Income (O), and SBA Communications (SBAC) are trading at multiples of 20.73x, 19.02x, and 20.05x, respectively.