A Look at AMD’s Target Capital Structure

AMD’s target capital structure is to maintain a cash balance of up to $1.0 billion. Any amount above this figure would be used to repay debt, which currently stands at $1.5 billion.

July 19 2017, Updated 7:35 a.m. ET

Cash flow

In the previous part of this series, we saw that Advanced Micro Devices (AMD) is looking to increase its net profit by reducing operating expenses and improving product mix. The increased profit would increase AMD’s FCF (free cash flow) after years of negative FCF.

AMD’s operating cash flow is equal to its net income. The company has been reporting a long-term net loss, which resulted in negative operating cash flow. The company paid for its daily operations and capital expenditure from its cash reserves, which reduced the cash in hand from more than $1 billion in fiscal 2014 to $784 million in fiscal 2015.

Cash and debt position

In fiscal 2015, AMD management stated that it aims to maintain the company’s cash position between $600.0 million–$1.0 billion. In fiscal 2016, the company returned to positive cash flows due to higher revenues and improved profits.

AMD also restructured its debt by replacing high-interest debt with low-interest debt with maturity in 2020. It also repaid $500.0 million in debt. This helped the company reduce its interest burden and increase its cash reserves to ~$1.3 billion.

AMD’s target capital structure

AMD’s target capital structure is to maintain a cash balance of up to $1.0 billion. Any amount above this figure would be used to repay debt, which currently stands at $1.5 billion. This equates to net debt of $500 million. In the long term, the company aims to have a net cash position, which means its cash reserves are greater than its long-term debt.

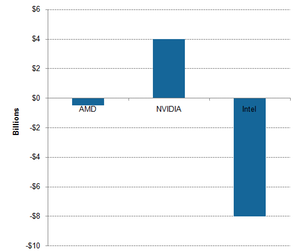

At present, NVIDIA (NVDA) has a net cash position of $4.0 billion while Intel (INTC) has a net debt position of $8.0 billion.

AMD also looks to have a net debt-to-EBITDA[1. earnings before interest, tax, depreciation, and amortization] ratio less than 2x. However, it must first report positive EBITDA, which is currently -$159.0 million. As AMD improves its profit margins, it would return to positive EBITDA and reduce its debt.

Due to negative EBITDA and FCF, the company has not paid any dividends to its shareholders. The shareholders earned returns through capital appreciation.

In the next article, we’ll look at AMD’s stock price movement and see if there is any further opportunity for price appreciation.