Why Some Are Investors Are Bullish on Crown Castle

REITs (real estate investment trusts) typically have to pay 90% of their taxable income to shareholders to qualify as an equity.

June 30 2017, Updated 7:36 a.m. ET

Why dividends matter for REITs

REITs (real estate investment trusts) typically have to pay 90% of their taxable income to shareholders to qualify as an equity. This gives the companies several tax benefits. REITs like Crown Castle International (CCI) use the rental income in order to fund shareholder returns, and these rental incomes provide a reliable and continuous source of funds and are directly proportional to inflation.

Consistent dividends

CCI has paid dividends to its shareholders in every quarter since it became a public company in 2014. In October 2016, CCI announced a quarterly dividend of $0.95 per share—up 7%—resulting in an annualized dividend of $3.80 per share.

The company expects to pay an aggregate amount of at least $1.3 billion over the next 12 months, and it has maintained a consistent dividend yield for the past two years. Its dividend yield was 3.87% in 2015 and 4.16% in 2016. Analysts expect Crown Castle to maintain a dividend yield of 3.87% for the next 12 months.

Peer group

Close competitors American Tower (AMT), Verizon Communications (VZ), and CenturyLink (CTL) have dividend yields of 1.9%, 5.1%, and 8.9%, respectively.

Notably, American Tower and Crown Castle together make up 11.5% of the PowerShares Active US Real Estate ETF (PSR).

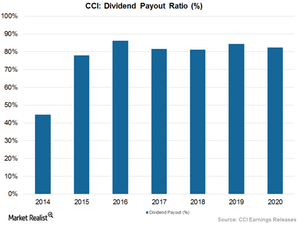

FFO payout ratio

The FFO (funds from operations) payout ratio gives an insight into the shareholder returns of a stock. The ratio implies the amount of FFO that a company distributes as its dividend and is calculated as the ratio between the dividend per share and diluted FFP per share for a given period.

CCI’s FFO payout ratio was 86% in 1Q17. The company’s expected payout ratios for the next four quarters are 83%, 80%, 82%, and 80% for 2Q17, 3Q17, 4Q17, and 1Q18, respectively.