Why Mining Stocks’ Relative Strength Levels Keep Falling

In this article, we’ll take a look at the variables that determine how attractive particular mining stocks or shares are or could become.

June 27 2017, Published 4:03 p.m. ET

Mining stocks tumbled

In this article, we’ll take a look at the variables that determine how attractive particular mining stocks or shares are or could become.

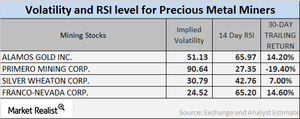

The technicals we’ll include are implied volatility and the 14-day RSI (relative strength index).

Implied volatility

Implied volatility is a measure of the comparative price change of a stock with respect to the variations in the price of its call option.

On June 26, 2017, the implied volatilities of Agnico Eagle Mines (AEM), Franco Nevada (FNV), Hecla Mining (HL), and Eldorado Gold (EGO) stood at 31.1%, 26.8%, 40.2%, and 49.1%, respectively. Remember that miners’ volatilities are often greater than precious metals’ volatilities.

Reading RSI levels

A stock’s 14-day RSI is a measure of whether it’s been oversold or overbought. An RSI level of higher than 70 suggests a possible fall in price, while anything below 30 suggests a possible rise in price. The RSI figures of most major miners have risen over the past week due to upward price corrections.

Often, the RSI score of a mining stock rises or falls when the company’s stock rises or falls, respectively. Agnico, Franco-Nevada, Hecla, and Eldorado have RSI scores of 34.7, 39.1, 30.8, and 35.3, respectively.

Investors can opt for precious metals–based funds such as the ETFS Physical Silver Shares ETF (SIVR) or the Physical Swiss Gold Shares ETF (SGOL), which have risen 4.3% and 14.5%, respectively, on a trailing-30-day basis.

In the next article, we’ll take a look at the correlations of a few mining companies with gold.