What’s Eating Kroger’s Sales Comps?

Kroger (KR) has done reasonably well lately, having survived an intensely competitive retailing environment over the past few years.

June 12 2017, Updated 4:35 p.m. ET

Kroger’s sales comps

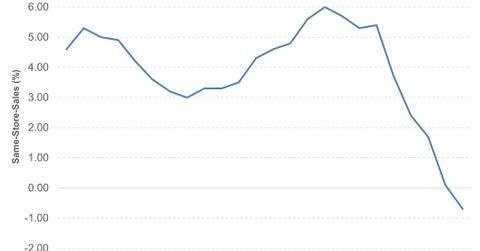

Kroger (KR) has done reasonably well lately, having survived an intensely competitive retailing environment over the past few years. The company delivered 52 consecutive quarters of positive comps (comparable same-store sales) during a time when leading traffic pullers including Whole Foods Market (WFM) faltered. But in fiscal 4Q17, which ended in January, Kroger’s comps drifted toward negative territory.

The retailer recorded a decline of 0.7% in comps excluding fuel in fiscal 4Q17, as compared to the consensus expectations of slightly positive comps. However, this fall was largely due to the deflationary headwinds that the entire food retailing sector has been facing.

Kroger’s inflation adjusted same-store-sales were, in fact, positive. Loyal households continued to grow and had slightly positive comps in fiscal 4Q17.

Looking forward

Kroger’s management expects a tough operating environment for at least first half of fiscal 2018. Sales comps (excluding fuel) are projected to be flat to slightly positive, but the first quarter results might be impacted by last year’s tough comparison of a 2.4% rise.

Notably, investors looking for exposure to Kroger through ETFs can check out the PowerShares Dynamic Food & Beverage Portfolio (PBJ), which has ~5.2% in KR.

Competitor comps

Kroger’s closest competitor in most markets, Wal-Mart Stores (WMT), recently reported solid comps. Its same-store sales grew 1.4%, beating the consensus expectation of 1.3%. Walmart, of course, has been stealing market share from other grocers and retailers by making continuous price investments.

Continue to the next part of this series for more on the increasing competition in the grocery space and Walmart’s price cuts.