Kansas City Southern: Its Intermodal Volumes in Week 23

KSU’s trailer volumes fell 9.5% in week 23, whereas container traffic contracted by 2.4% in the same week.

Nov. 20 2020, Updated 2:49 p.m. ET

KSU’s intermodal volumes

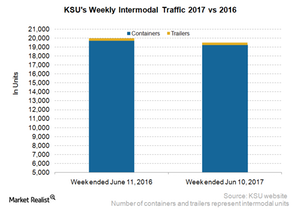

In week 22 of 2017, the United States’ smallest Class I railroad, Kansas City Southern (KSU), witnessed a slump in its intermodal volumes. Week 23 was a no exception. In that week ended June 10, 2017, Kansas City Southern reported a YoY (year-over-year) 2.5% fall in intermodal volumes.

The fall in trailer volumes was more rapid than the fall in container volumes. Trailers constitute a small percentage of total intermodal volumes measured in containers and trailers. KSU’s trailer volumes fell 9.5% in week 23, whereas container traffic contracted by 2.4% in the same week.

Against the expanding intermodal traffic posted by US railroads, Kansas City Southern (KSU) reported a drop in the same category.

Kansas City Southern’s intermodal expansion

KSU operates in Mexico where Union Pacific (UNP) has an ~26% stake in Ferromex, a competitor of KSU. In November 2016, BNSF Railway (BRK-B) and Kansas City Southern (KCS) announced a new joint service to offer intermodal transportation.

This service connected the Chicago and the Dallas/Fort Worth markets with other vital markets in the BNSF network with important industrial and consumer regions in KSU’s Mexico network.

In Mexico, KSU faces stiff competition from the trucking industry. KCSM’s intermodal business competes with Landstar System (LSTR), Trinity Logistics, and ByExpress Logistics.