Inside Crown Castle’s Business Model

Crown Castle is expected to ride high on higher profitability, and analysts expect it to register significant AFFO (adjusted funds from operations) growth.

June 28 2017, Updated 4:35 p.m. ET

Higher profit ensured in the future

Crown Castle International (CCI) is expected to ride high on higher profitability, and analysts expect the company to register AFFO (adjusted funds from operations) growth of 22.9%, 23.6%, 21%, 19%, over the next four quarters, respectively.

Greater profitability, an expected increase in its network services’ gross margin, and increased tower leasing activities have prompted CCI’s management to increase its AFFO guidance for 2017.

Predictability of business reduces risk of negative surprises

A cell tower business like CCI’s ensures profitability and predictability of results. Cell tower owners need fewer maintenance costs, and each of the company’s cell towers can lease from two to five tenants. The addition of a tenant to a tower involves minimal additional costs but adds income.

CCI’s leases range from five to 15 years, and the weighted-average remaining life of a lease of six years represents ~$19 billion in future cash flows (as of December 31, 2016).

At the same time, high renewal rates and several master leases with major customers ensure future profitability. Master lease agreements also reduce the probability of churn rates, apart from reducing colocation cycle times.

Long-term leases

CCI’s renewal periods range from five to 15 years, and the weighted average remaining life of lease of six years represents ~$19 billion in future cash flows as of December 31, 2016.

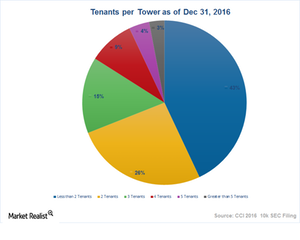

As of December 31, 2016, CCI had less than two tenants in 43% of its towers, two tenants in 26% of its towers, 33 tenants in 15% of its towers, four tenants in 9% of its towers, five tenants in 4% of its towers, and around five tenants in 3% of its towers.

Customers include major players in the industry

For 2016, Crown Castle’s customers who rent wireless towers include wireless carriers operating in national networks. Carriers who rent its small cell networks include businesses with higher bandwidth demands like enterprises, government organizations, education organizations and wholesale customers.

For 2016, ~90% of CCI’s site rental revenues were derived from the major customers like AT&T (T), Verizon Communications (VZ), T-Mobile (TMUS), and Sprint (S).

Notably, Crown Castle makes up ~5% of the PowerShares Active US Real Estate ETF (PSR).