Deere: Analysts’ Recommendations and Target Prices

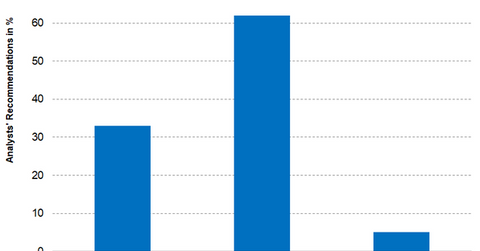

For Deere, 33% of the analysts recommended the stock as a “buy,” 62% recommended the stock as a “hold,” and 5% recommended the stock as a “sell.”

Sept. 20 2017, Updated 9:10 a.m. ET

Analysts’ consensus on Deere

The number of analysts tracking Deere (DE) fell from 22 to 21 analysts. It’s important to note that 33% of the analysts recommended the stock as a “buy,” 62% recommended the stock as a “hold,” and 5% recommended the stock as a “sell.”

Analysts’ consensus indicates that Deere’s 12-month target price is $130.61, which implies a potential return of 9.0% from the closing price of $119.79 as of September 18, 2017.

Most analysts recommend a “hold”

Deere reported better-than-expected earnings in fiscal 3Q17 and revised its earnings and revenue for fiscal 2017. Deere expects its net income to be at $2.07 billion—compared to the earlier guidance of $2.0 billion. Deere revised the revenue from its equipment operations. It expects the revenue to rise 10.0%—compared to the previous guidance of 9.0%. As a result, most of the analysts recommended the stock as a “hold.”

Individual brokerage firms

- RBC recommended a target price of $134.00 for Deere, which implies a return potential of 11.80% from the closing price of $119.89 as of September 18, 2017.

- Deutsche Bank (DB) rated Deere as a “hold.” It recommended a target price of $135, which implies a return potential of 12.60% over the closing price of $119.89 as of September 18, 2017

- Credit Suisse (CS) rated Deere as “outperform” with a target price of $148.00, which implies a return potential of 23.40% over the closing price of $119.89 as of September 18, 2017.

Investors looking for indirect exposure to Deere can invest in the iShares MSCI Global Agriculture Producers ETF (VEGI). VEGI has invested 9.0% of its holdings in Deere. The fund also provides exposure to Monsanto (MON) with a weight of 14.50% as of September 18, 2017.