Comparing the Valuation Multiples of Cannabis Stocks

In this part of our cannabis valuation series, we’ll discuss the multiples of the remaining cannabis stocks and compare them to the peer (MJ) median of 24x.

Nov. 20 2020, Updated 4:52 p.m. ET

Valuation multiples

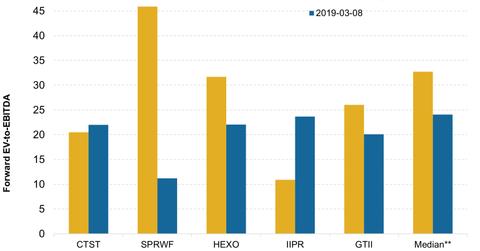

In this part of our cannabis valuation series, we’ll discuss the multiples of the remaining cannabis stocks and compare them to the peer (MJ) median of 24x.

Trading at a discount

All of the stocks in the chart above were trading at discounts to the peer median on March 8. CannTrust (CTST) was trading at a forward valuation multiple of 22x. However, the stock was trading at a premium to its historical average of 20.5x. Innovative Industrial Properties (IIPR) was also trading at a discount to the peer median at 23.7x, but it was trading at a premium to its historical average of 10.9x.

Supreme Cannabis (SPRWF) was trading at 11.2x, HEXO (HEXO) was trading at 22x, and Green Thumb Industries (GTBIF) was trading at 20x, which were all at a discount to the peer median on March 8. These three stocks were also trading at discounts to their historical averages of 45.9x, 31.7x, and 26.5x, respectively.

In contrast, at 39x, KushCo Holdings (KSHB) was trading at a premium to the peer median on March 8.

For more updates on the industry, visit Market Realist’s Healthcare page.