Comparing American Tower with Retail REITs in Its Industry

AMT’s current price-to-FFO multiple is ~20.1x.

June 14 2017, Updated 10:35 a.m. ET

Price-to-FFO multiple

The most common way of assessing the relative value of a REIT like American Tower (AMT) is by using its price-to-FFO (funds from operations) multiple. FFO is the most widely used metric for evaluating REITs.

A REIT’s price-to-FFO multiple is same as that of the PE (price-to-earnings) ratio used to calculate a relative value for companies in other industries.

Peer group price-to-FFO multiples

AMT’s current price-to-FFO multiple is ~20.1x. Traditionally, the higher price-to-FFO multiple for AMT implies that the company has been returning consistent capital value as well as reliable, steady dividend yields to investors.

The company has initiated several acquisitions and strategic partnerships to boost its presence in high-demand geographies. It has also increased its funds from operations and revenue guidance for fiscal 2017. These actions may have given a push to its price movement.

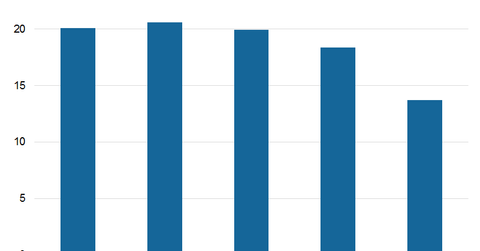

With respect to its price-to-FFO multiple, AMT stock trades in line with its peers, with the exception of Simon Property Group (SPG). SPG trades at a low price-to-FFO multiple of 13.5x.

Among the price-to-FFO multiples of AMT’s peers, SBA Communications (SBAC) is trading at ~20.1x, Crown Castle International (CCI) is trading at ~20.6x, and Realty Income (O) is trading at ~18.3x.

Peer group dividend yields

Currently, American Tower is offering a next-12-month (or NTM) dividend yield of 2.2%, which is in line with its close competitors. Crown Castle has a dividend yield of 3.9%, Realty Income has a dividend yield of 4.7%, and Simon Property Group has a dividend yield of 4.8%.

Net asset value is also used to value REITs. American Tower (AMT) comprises 7% of the PowerShares Active US Real Estate ETF (PSR), which has a net asset value of ~77.3%. AMT has a net asset value of -2%, CCI has a net asset value of -5.9%, and SBAC has a net asset value of -0.6%.

In the final article in this series, we’ll see how Wall Street analysts view AMT.