US Dollar and US Treasuries Are Slightly Weaker

In the early hours on Wednesday, the US Dollar Index is slightly weaker. At 5:45 AM EST on June 14, the US Dollar Index was trading at 96.99—0.01% higher.

June 14 2017, Published 9:59 a.m. ET

US dollar

After regaining some strength last week, the US Dollar Index started this week on a weaker note and fell in the first two trading days. In the early hours on Wednesday, the US Dollar Index is slightly weaker.

With the Fed’s two-day interest rate decision meeting coming to an end today, the market is looking forward to the Fed’s statement. With most market participants expecting an interest rate hike, the market’s focus is on the Fed’s market outlook. The US dollar lost upward momentum before the beginning of the interest rate meeting on Tuesday. Weaker-than-expected economic data on June 13 also weighed on the US Dollar Index. According to data released by the U.S. Bureau of Labor Statistics, the US Producer Price Index remained unchanged in May. The market was expecting a reading of 0.1%.

At 5:45 AM EST on June 14, the US Dollar Index was trading at 96.99—a gain of 0.01%.

US Treasury yields

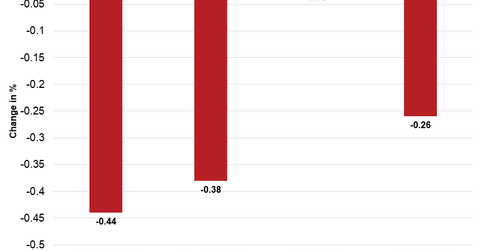

After regaining strength last week, US Treasury yields started this week on a stable note. On Tuesday, 30-year and ten-year Treasury yields pulled back. Two-year and five-year Treasury yields, which are more sensitive to the interest rate decision, moved higher. US Treasury yields are slightly weaker in the early hours on June 14 ahead of the Fed’s interest rate decision.

At 6:00 AM EST on June 14:

- The ten-year Treasury yield was trading at 2.199 – a fall of ~0.38%

- The 30-year Treasury yield was trading at 2.851 – a fall of ~0.38%

- The five-year Treasury yield was trading at 1.775 – a fall of ~0.3%

- The two-year Treasury yield was trading at 1.355 – a fall of ~0.56%

The iShares 20+ Year Treasury Bond ETF (TLT) rose 0.02%. The ProShares UltraPro Short 20+ Year Treasury ETF (TTT) and the ProShares UltraShort 20+ Year Treasury ETF (TBT) fell 0.33% and 0.03%, respectively, on June 13.