Why TJX Companies’ 2Q Margins Could Be Under Pressure

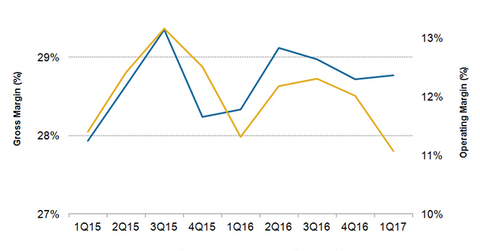

TJX Companies’ (TJX) gross margin in fiscal 1Q17 rose by 50 basis points on a year-over-year basis to 28.8%.

Aug. 15 2016, Updated 9:06 a.m. ET

Gross margin expectations

TJX Companies’ (TJX) gross margin in fiscal 1Q17, which ended April 30, 2016, rose by 50 basis points on a year-over-year basis to 28.8%. This increase was driven by buying and occupancy cost leverage on higher same-store sales in fiscal 1Q17.

In the 1Q17 conference call, the company’s chief financial officer, Scott Goldenberg, stated that the fiscal 2Q17 gross margin is expected to be in the 28.7%–28.8% range. This estimate indicates a decline in 2Q17 gross margin compared to 29.1% in 2Q16. The company expects this decline in the 2Q17 gross margin to be caused by continued currency headwinds and planned costs related to the opening of its new distribution center.

Decline in operating margin

TJX Companies’ operating margin declined to 11.1% in fiscal 1Q17 from 11.3% in fiscal 1Q16. This decline was primarily due to a 70-basis-point rise in SG&A (selling, general, and administrative) expenses as a percentage of sales. The rise in expenses was a result of higher wages and investments to support the company’s growth plans. The iShares Global Consumer Discretionary ETF (RXI) invests 1.4% of its holdings in TJX Companies.

The operating margin of Ross Stores (ROST) in the comparable first quarter declined by 30 basis points to 15.4%. This contraction was a result of the deleveraging of expenses on weak same-store sales and increased wages. Burlington Stores’ (BURL) operating margin grew 100 basis points to 5.8% in the first quarter, driven by lower SG&A expenses as a percentage of sales. This improvement was a result of the leverage in occupancy and advertising spending on strong same-store sales.

Nordstrom’s (JWN) 1Q16 operating margin fell to 3.3% from 7.6% in 1Q15 due to higher credit chargebacks and severance charges. Nordstrom competes with off-price retailers through its Nordstrom Rack stores.

Operating margin under pressure

TJX Companies’ operating margin in fiscal 1Q17 is likely to be burdened by higher SG&A expenses. The company expects its SG&A expenses as a percentage of sales to be in the 17.8%–17.9% range in fiscal 2Q17, compared to 16.9% in fiscal 2Q16. The rise in expenses is expected due to higher wages and investments to support the company’s growth.

We’ll discuss the movement in TJX Companies’ stock price in the next part of this series.