Comparing Norfolk Southern’s Intermodal Traffic with CSX’s

Norfolk Southern’s intermodal traffic Norfolk Southern’s (NSC) total intermodal traffic rose 6.5% in the week ended April 29, 2017. Its volumes reached ~78,000 containers. Norfolk’s container traffic rose 5.6%, and its trailer traffic rose 15.6% YoY (year-over-year) to nearly 6,900 units, compared with 5,900 units in the week ended April 30, 2016. Since the beginning of […]

May 9 2017, Updated 7:37 a.m. ET

Norfolk Southern’s intermodal traffic

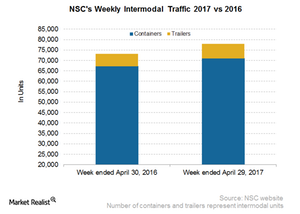

Norfolk Southern’s (NSC) total intermodal traffic rose 6.5% in the week ended April 29, 2017. Its volumes reached ~78,000 containers. Norfolk’s container traffic rose 5.6%, and its trailer traffic rose 15.6% YoY (year-over-year) to nearly 6,900 units, compared with 5,900 units in the week ended April 30, 2016. Since the beginning of 2017, Norfolk Southern’s overall intermodal traffic has risen 6.5% YoY, a healthy rise compared with that seen by rival CSX.

Why is intermodal traffic vital for Norfolk?

Norfolk’s rise in trailer volumes appears to mark the end of its hardship due to the restructuring of TCS (Triple Crown Services), its underperforming subsidiary. Norfolk has been shifting shippers to other intermodal lanes. Post-restructuring, TCS aims to focus on specific merchandise such as auto parts (TM).

Norfolk Southern expects its truck capacity (JBHT) to tighten in 2H17. It also anticipates that its implementation of fixing ELDs (electronic logging devices) in trucks will result in service issues, paving the way for railroad intermodal traffic to benefit from the situation.

According to Norfolk Southern, its inventory-to-sales ratio has fallen to its lowest point since 2014. This fall should boost its intermodal volumes in the coming quarters.

Investing in ETFs

Railroad companies make up part of the industrial sector. If you want exposure to the transportation and logistics sector, you can invest in the First Trust Industrials/Producer Durables AlphaDEX ETF (FXR). FXR’s portfolio holdings include major US airlines and railroad companies. In the next article, we’ll look at the freight volumes of Norfolk Southern’s primary rival, CSX (CSX).