Trailers Hurt Kansas City Southern’s Intermodal Volume in Week 16

In the past few weeks, Kansas City Southern (KSU), the smallest Class I railroad company in the United States, has seen its intermodal traffic slow.

May 1 2017, Updated 9:06 a.m. ET

Kansas City Southern’s intermodal traffic

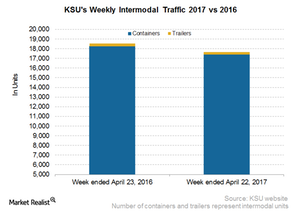

In the past few weeks, Kansas City Southern (KSU), the smallest Class I railroad company in the United States, has seen its intermodal traffic slow. In the week ended April 22, 2017, KSU reported a YoY (year-over-year) fall of 4.8% in its overall intermodal traffic.

There was fall of 11% in trailer volumes of KSU’s overall intermodal volumes. The company’s container volumes also fell 4.7% in the 16th week of 2017.

Does intermodal traffic matter to KSU?

KSU operates in Mexico through KCSM (Kansas City Southern de México). KSU receives nearly 48.0% of its revenue from its Mexican operations. In 2016, KCSM’s intermodal traffic accounted for 16.0% of the company’s total revenue. In Mexico, the company has the sole concession to serve the busy Port of Lázaro Cárdenas.

However, given President Donald Trump’s ongoing talks of constructing a wall on the US-Mexican border, we should pay attention to how KSU’s business compares to those of other US Class I railroad companies.

Apart from seasonality, intermodal traffic is affected by exclusive access to ports, highway-to-rail conversions, and retail sales. KSU’s US intermodal business competes with major Western US carriers such as BNSF Railway (BRK-B) and Union Pacific (UNP). In Mexico, KCSM’s intermodal competes with Landstar System (LSTR), Trinity Logistics, and ByExpress Logistics.

ETF investments

If you want exposure to the transportation sector, you can invest in the Guggenheim S&P 500 Equal Weight ETF (RSP). All US-originated Class I railroad companies are part of RSP’s portfolio holdings.

Let’s move on to the next part of this series to look at the traffic of Canada’s largest freight rail carrier, Canadian National Railway (CNI).