How IBM’s Systems Segment Has Been Performing

In this part of the series, let’s see how IBM’s (IBM) Systems segment performed in 1Q17. The Systems segment includes systems hardware and OS (operating system) software.

June 5 2017, Updated 7:36 a.m. ET

Systems segment’s revenue fell ~17%

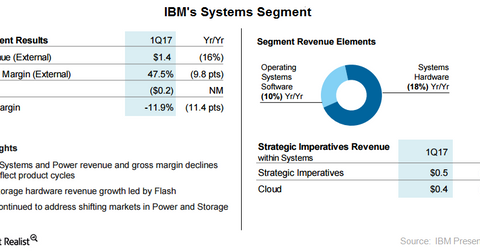

In this part of the series, let’s see how IBM’s (IBM) Systems segment performed in 1Q17. The Systems segment includes systems hardware and OS (operating system) software. Among IBM’s operating segments, this one’s revenue fell the most in 1Q17.

The System’s segment’s revenue fell 16.8% to $1.4 billion in 1Q17, missing analysts’ expectations of $1.5 billion. In this segment, the systems hardware business, which sells servers and storage, fell 18%, while the OS software business fell 10%. Strategic imperatives revenue fell 15%, while cloud revenue rose 16%.

System z and POWER8 servers’ revenues continued to fall

After the sale of its x86 servers to Lenovo (LNVGY), IBM streamlined its hardware business with its POWER8 servers and its System z mainframe business.

Cyclical pressures for IBM’s System z led to a fall in the segment’s revenue growth. System z saw a revenue fall of 40%. It was last refreshed in early 2015. IBM’s power servers also registered a 27% fall as growing Linux workloads failed to counterbalance UNIX declines.

Storage emerged as a strong point, with hardware sales rising 7% due to flash storage demand.

Later, we’ll discuss IBM’s strategic partnership with Nutanix (NTNX) and how it could affect Intel (INTC).