Financials Have Soared, Mostly Due to Trump’s Promises

The financial sector has performed the best since the elections. Higher interest rates are likely to improve banks’ margins going forward.

April 4 2017, Published 9:02 a.m. ET

Direxion

Financial sector moves have been strong

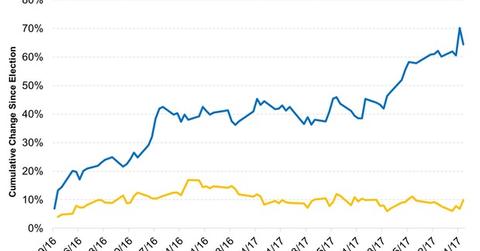

The market appears to believe that better times lie ahead for financials. First, the Trump administration has repeatedly promised to repeal parts of the Dodd-Frank Act, which would presumably free up bank capital to chase higher-growth initiatives. Plus, interest rates have been rising due to Fed talk and hope for higher growth going forward. But note that the 24% move in the space is almost identical while interest rates rose. Part of the move is therefore captured in interest rates and part is out of hope for higher earnings. The chart below tracks how much stocks have moved compared to interest rates. The real move in the multiple still suggests a lot of change to come. Direxion’s FAS product (3X Bull) and FAZ product (3X Bear) can help invest in that view—whichever direction it takes you.

Market Realist

The above graph compares the performances of the Direxion Daily Financial Bull 3X ETF (FAS) and the Direxion Daily 7-10 Year Treasury Bear 3x ETF (TYO) since the US elections in November 2016. Since higher interest rates cause a backup in yields and cause Treasuries to underperform, we’ve considered the Treasury Bear ETF, which gives positive gains when interest rates rise.

The correlation between FAS and TYO has been +0.24 since the elections. That means interest rates have explained 24.0% of the returns on financials. There were rate hikes in December 2016 and March 2017.

The financial sector has performed the best since the elections. Higher interest rates are likely to improve banks’ margins going forward. The Dodd-Frank Act required banks to hold a higher percentage of capital, creating a negative impact on banks.

The second graph compares the financial sector’s performance with banks’ ROE (return on equity). As you can see, banks’ ROE was well above 13.0% before the financial crisis. However, after the crisis, the Dodd-Frank Act meant that banks couldn’t lend as much as they did before the crisis. That had a direct impact on ROE, which has been below 10.0% since the crisis.

As the graph suggests, financials have followed the trajectory of ROE. Also, lower interest rates since the financial crisis meant that banks had to lend at lower rates, further squeezing their margins. But that could change as higher interest rates and the repeal of the Dodd-Frank Act lead to robust earnings growth in this sector.