Analyzing Schlumberger’s Growth Drivers in 1Q17

Schlumberger’s (SLB) Drilling segment witnessed the highest revenue fall of 20% in 1Q17—compared to 1Q16. Its Production segment fell ~8%.

Nov. 20 2020, Updated 3:05 p.m. ET

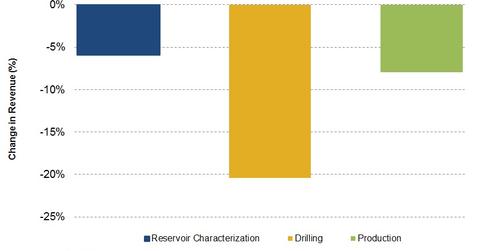

Schlumberger’s revenue by segment

Schlumberger’s (SLB) Drilling segment witnessed the highest revenue fall of 20% in 1Q17—compared to 1Q16. Its Production segment fell ~8%, while its Reservoir Characterization segment fell 6%. In 2Q16, Schlumberger added Cameron to its product group following the acquisition of Cameron International on April 1, 2016. Schlumberger generated $1.2 billion on revenues from Cameron in 1Q17. Schlumberger accounts for 6.5% of the ProShares Ultra Oil & Gas ETF (DIG).

In terms of geography, Schlumberger’s revenue from North America did better in 1Q17 compared to 4Q16—up ~6%. Its revenue from the Europe/CIS/Africa region fell 10% during the same period.

Schlumberger’s segment margin analysis

The Reservoir Characterization segment’s 1Q17 operating income margin fell to 17% from 19% last year. The Production segment’s operating margin fell from 9% in 1Q16 to 5% in 1Q17. The Drilling segment’s operating margin fell to 12% in 1Q17 from 15% in 1Q16. To learn more, read Stumbling Blocks Could Be on the Horizon for Schlumberger.

Negative factors impacting Schlumberger’s 1Q17 results

- fall in offshore drilling activity

- lower multiclient license sales in the WesternGeco unit

- reduced project volume and product sales in Cameron Group

- seasonal activity decline in the Northern Hemisphere

- continued pricing pressure on Schlumberger’s new tender awards

- pricing pressure and lower fracturing activity in the Middle East

Schlumberger’s growth drivers

- accelerated North America onshore drilling activity, driven by strong fracking and higher stage count

- higher pricing due to improved capacity utilization in North America

- higher rig count in Canada

- stronger OneSubsea activity in Brazil

Next, we’ll discuss Schlumberger’s returns.