H.B. Fuller Has Another Round of Price Hikes

On March 7, 2016, H.B. Fuller (FUL) announced another round of price hikes for its products. It came on the back of other price hikes the week before.

March 13 2017, Published 3:28 p.m. ET

H.B. Fuller increased prices of synthetic polymers and adhesives

On March 7, 2016, H.B. Fuller (FUL) announced another round of price hikes for its products. It came on the back of increased prices for its adhesives in North America in the previous week. The company raised prices for all emulsion polymer products, including brands such as Pace, Plyamul, Copro, and Elvace. The price increases will be effective on April 3, 2017, or as the contract allows. These new prices will impact the United States and Canada. PPG increased the prices primarily due to an increase in monomer costs.

H.B. Fuller also increased prices for its adhesives in Central and South America, effective April 3, 2017. It raised those prices 5.0%–10.0%. The impact of the price increase could be seen in 2Q17.

H.B. Fuller stock

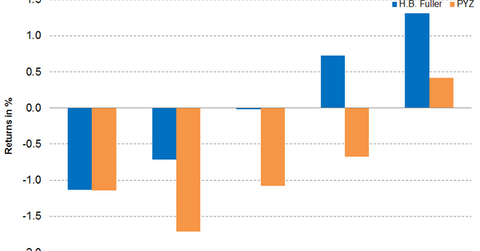

On March 10, 2017, FUL closed at $49.43, rising 0.10% for the week. It was trading 3.2% above its 100-day moving average of $47.89, indicating an upward trend. Analysts expect FUL’s 12-month target price to be $50.25, implying a potential return of 1.7% over its closing price on March 10, 2017. Year-to-date, the stock has risen 2.3%.

Its 14-day RSI (relative strength index) of 52 indicates that the stock is neither overbought nor oversold. An RSI of 70 and above indicates that a stock is overbought, while an RSI of 30 and below indicates that a stock is oversold.

The PowerShares DWA Basic Materials Momentum ETF (PYZ), which holds 2.1% in FUL as of March 10, 2017, underperformed FUL by falling 4.1% for the week to close at $60.56. The top holdings of the fund include Chemours (CC), Cliffs Natural Resources (CLF), and Avery Dennison (AVY), with weights of 5.3%, 3.8%, and 3.8%, respectively.