Why 3M Is Trading at a Premium Compared to Its Peers

In this article, we’ll look at MMM’s latest valuations and compare them to its peers’. On July 3, 2017, MMM was trading at a one-year forward PE of 22.70x.

July 6 2017, Updated 9:07 a.m. ET

3M’s forward PE

In the previous article, we looked at analysts’ recommendations for 3M Company (MMM). In this article, we’ll look at MMM’s latest valuations and compare them to its peers’.

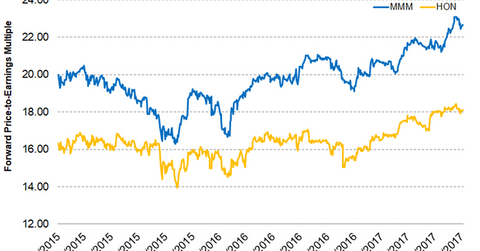

On July 3, 2017, MMM was trading at a one-year forward price-to-earnings ratio (or PE) of 22.70x, while its peer Honeywell International (HON) was trading at a one-year forward PE of 18.10x.

Forward PE is a tool that investors can use to compare between two or more companies operating in the same industry to verify whether a company is undervalued or overvalued. The one-year forward PE considers future earnings and tells us how much an investor is paying for a stock per dollar of expected earnings over the next 12 months.

MMM is trading at a premium

At present, MMM is trading at a premium to its peer Honeywell. MMM’s focus on consolidating its portfolio from 40 businesses to 25 businesses is in progress. In this regard, MMM has already divested a few of its businesses. It’s also acquired Scott Safety, which has partially offset its divestitures.

The company’s divestitures are expected to bring down its operating expenses. However, these divestitures are also expected to affect its revenue. Analysts expect MMM to post earnings per share (or EPS) of $8.95 in 2017, implying a rise of 9.7% over 2016. In 2018, analysts expect MMM to post EPS of $9.58, a rise of ~7.1% over 2017.

On the other hand, analysts expect Honeywell to post EPS of $7.03 in 2017, implying a rise of 13.4% over 2016, and a further rise of 8.7% in 2018. Because HON’s growth rate is better than MMM’s, it appears that HON could be undervalued.

You can indirectly hold MMM by investing in the ProShares Ultra Dow30 ETF (DDM), which invests 4.5% of its portfolio in MMM. The top holdings of the fund include Goldman Sachs (GS) and Boeing (BA) with weights of 4.9% and 4.3%, respectively, as of July 3, 2017.