Ratner Leaves RPM International’s Board of Directors

On February 24, 2017, RPM International (RPM) announced that Charles Ratner would be retiring from RPM’s board of directors after serving the company for 12 years.

Feb. 28 2017, Updated 11:35 a.m. ET

Ratner retires from RPM International

On February 24, 2017, RPM International (RPM) announced that Charles Ratner would be retiring from RPM’s board of directors after serving the company for 12 years. Ratner was associated with RPM’s board of compensation committee.

Frank Sullivan, RPM’s CEO and chair, said, “During Chuck’s tenure, RPM’s annual sales have nearly doubled from $2.6 billion to more than $5 billion, and the annual dividend paid to our shareholders has increased from $0.60 to $1.20 per share. His contributions played an important role in this strong performance.”

RPM stock price

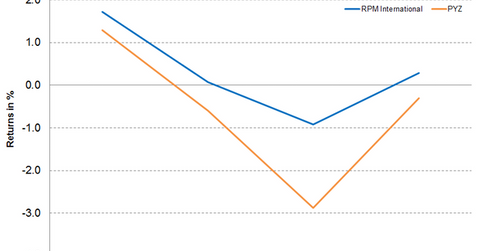

On February 24, 2017, RPM closed at $53.66, a gain of 1.1% for the week. The PowerShares DWA Basic Materials Momentum ETF (PYZ), which holds 2.6% in RPM as of February 24, fell 2.5% for the week and closed at $62.44.

RPM stock closed 3.8% above its 100-day moving average of $51.70. Analysts expect RPM’s 12-month target price to be $56.90, implying a potential return of 6.0% from the closing price on February 24, 2017. RPM is trading 31.7% above the 52-week low of $40.73, while it’s trading 4.0% lower to its 52-week high of $55.92. The 14-day relative strength index of 60 indicates that the stock is neither overbought nor oversold. An RSI of 70 and above indicates that the stock is overbought, while an RSI of 30 and below indicates that the stock is oversold.

You can hold RPM indirectly by investing in the PowerShares DWA Basic Materials Momentum ETF (PYZ). Some top holdings of this fund include Chemours (CC), Cliffs Natural Resources (CLF), and Steel Dynamics (STLD) with weights of 5.1%, 4.2%, and 3.4%, respectively, as of February 24, 2017.