Looking Ahead: What Could Drive VFC in Fiscal 2017?

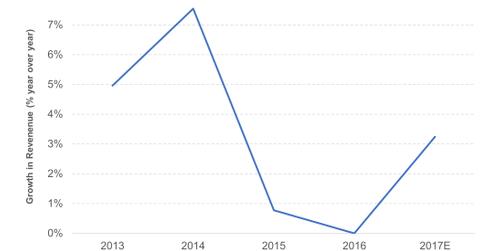

After reporting flat top-line growth in fiscal 2016, VF Corporation’s (VFC) management is looking for a low single-digit percentage increase in the company’s fiscal 2017 top line.

Feb. 27 2017, Updated 9:06 a.m. ET

Revenues could grow at a low single-digit rate in fiscal 2017

After reporting flat top-line growth in fiscal 2016, VF Corporation’s (VFC) management is looking for a low single-digit percentage increase in the company’s fiscal 2017 top line. Currency headwinds are likely to continue well into 2017 and cause a 2% negative impact on the top line. In this article, we’ll discuss the management’s guidance for VFC’s fiscal 2017 top line and its key drivers.

Key revenue drivers in fiscal 2017

VFC’s management plans to increase its focus on its key brands: The North Face, Vans, and Timberland. The company expects these brands to register high single-digit growth collectively.

In our view, international markets should remain healthy. In particular, Europe and Asia are expected to nearly double their growth rates and grow at high single-digit rates.

Channel headwinds in the company’s American region are expected to continue and impact the Jeanswear business in fiscal 2017 as well. VFC’s Jeanswear revenues are expected to remain flat as low single-digit growth in European and Asian countries could be washed away by a revenue decline in the Americas. Wrangler and Lee International are likely to grow at a low single-digit rate during the year.

VFC’s Imagewear business is expected to grow at a low single-digit rate in fiscal 2017. Its Workwear business is projected to drive growth for this segment.

The Sportswear segment could witness a high single-digit rate decline as Nautica continues to face channel pressures.

Investors who want exposure to VFC can consider the First Trust Rising Dividend Achievers ETF (RDVY), which invests ~1.9% of its portfolio in VFC.