How Flotek Industries Is Valued versus Peer Stocks

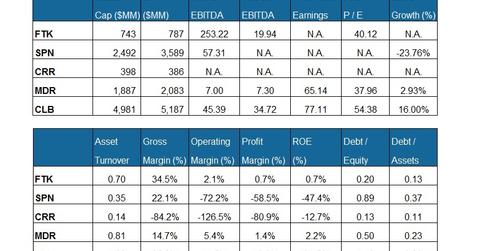

Core Laboratories (CLB) is the largest company by market capitalization among our set of select oilfield services and equipment (or OFS) companies…

March 1 2017, Updated 9:05 a.m. ET

Comparable company analysis

EV/EBITDA

Flotek Industries’ (FTK) EV (approximately the sum of its equity value and net debt), when scaled by trailing-12-month (or TTM) adjusted EBITDA, is higher than peer average in the group. McDermott International (MDR) has the lowest TTM EV/EBITDA multiple in our group.

Forward EV/EBITDA is a useful metric to gauge relative valuation. FTK’s forward EV-to-EBITDA multiple compression versus its TTM EV/EBITDA is steeper than the peer average because the expected rise in FTK’s adjusted operating earnings (or EBITDA) in the next 12twelve months is more extreme than peers’ average. This difference typically reflects a higher current EV/EBITDA multiple.

Debt levels

FTK’s debt-to-equity (or leverage) multiple is lower than the group average. A lower multiple could indicate decreased credit riskiness, which is comforting—particularly when crude oil prices are volatile. CLB’s leverage is the highest in our group. Flotek Industries is 0.07% of the iShares S&P Small-Cap 600 Growth ETF (IJT). The energy sector makes up 2.7% of IJT.

Price-to-earnings ratio (or PE)

Flotek Industries’ current valuation, expressed as a TTM PE multiple, isn’t meaningful as a result of negative earnings. Its forward PE multiple is positive, which reflects analysts’ expectation of positive EBITDA in the next 12 months.