Chemours Beat Analysts’ 4Q16 Revenue Estimates

Chemours (CC) reported its 4Q16 results on February 15, 2017, after the markets closed. Chemours reported 4Q16 revenue of $1.32 billion.

Feb. 17 2017, Published 10:58 a.m. ET

4Q16 revenues

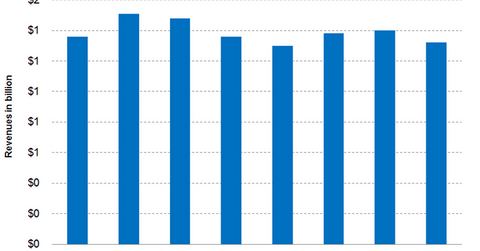

Chemours (CC) reported its 4Q16 results on February 15, 2017, after the markets closed. Chemours reported 4Q16 revenue of $1.32 billion. It beat analysts’ estimate of $1.24 billion. Its 4Q16 revenue reflected a fall of 2.8% on a year-over-year basis.

The fall in 4Q16 sales was primarily driven by the portfolio changes that took place throughout the year that involved closing and selling businesses. On the other hand, strong growth in titanium dioxide prices and continued strong demand for Opteon refrigerants were positive for Chemours.

Chemours’ outlook

Mark Vergnano, Chemours’ president and CEO, said, “We expect transformation plan savings, an improving pricing environment for TiO 2 and increased Opteon TM refrigerants adoption to remain drivers of our growth.”

Stock price reaction

Since the results were announced after the markets closed, stock prices fell 2.4% the next day. However, the stock rose ~14.3% on the news that the Ohio PFOA (perfluorooctanoic acids) litigation has been settled. The litigation involved ~3,500 lawsuits. Investors seemed happy that the settlement amount of $670.70 million is equally split between Chemours and DuPont (DD). The settlement paves the way for a spike in Chemours’ stock price.

In this series, we’ll discuss Chemours’ 4Q16 earnings in detail. We’ll also look into how Chemours’ reporting segments performed in 4Q16 and analysts’ latest recommendations for Chemours.

ETF investment

Investors can indirectly hold Chemours by investing in the PowerShares DWA Basic Materials Momentum Portfolio ETF (PYZ). PYZ has 5% of its holdings in Chemours. PYZ’s other top holdings include Cliffs Natural Resources (CLF) and Steel Dynamics (STLD). They have weights of 3.7% and 3.6% as of February 15, 2017.

In the next part, we’ll look into Chemours’ earnings in 4Q16.