Ares Capital’s Preference for Second Lien Continued in 4Q16

Ares Capital has consistently enhanced its exposure to second lien debt in a bid to generate higher yields. In 4Q16, its second lien debt made up 33% of its new commitments.

Feb. 28 2017, Updated 7:37 a.m. ET

Second lien investments

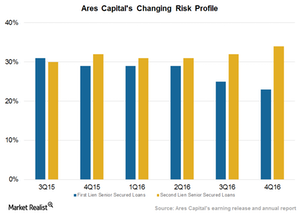

Ares Capital (ARCC) has consistently enhanced its exposure to second lien debt in a bid to generate higher yields. In 4Q16, its second lien debt made up 33% of its new commitments, compared to its exits at 20%. The company’s second lien portfolio represents 34% of its total portfolio, compared to 32% in the previous quarter. Its first lien senior secured loans represent 23% of its portfolio, compared to 25% in the previous quarter.

The company’s exposure to first lien loans has consistently fallen, from 34% in 1Q15 to 23% in 4Q16. It’s targeting a minimum of a 4% higher yield for second lien loans than what it generates on first lien senior loans.

Ares Capital is adopting a different strategy in a bid to boost the yields of its overall portfolio. The company’s overall risk profile has deteriorated marginally due to these changes. However, it remains competitive compared to industry averages. Ares Capital’s management believes that a careful selection of portfolio companies could help it to reduce the risks arising from its deployment of funds in a second lien over a first lien.

Ares Capital has generated a return of 7% on its equity. Here’s how some of the company’s investment management peers have performed in terms of returns on equity:

Together, these companies form 6.3% of the PowerShares Global Listed Private Equity ETF (PSP).

1Q17 net exits

Through February 2017, Ares Capital has made new investment commitments of ~$342 million, of which $324 million have been funded. Of these total new commitments, 55% have been made in first lien senior secured loans, and 45% have been made in second lien loans. The weighted average yield of debt and other securities funded during the period at amortized cost is 8.8%.

The company has also exited ~$399 million worth of investment commitments in February 2017. The weighted average yield of its debt and other income-producing securities exited or repaid during the period at amortized cost is 8.9%.

In the next article, we’ll study Ares Capital’s Senior Direct Lending Program in 4Q16.