Ares Capital’s 4Q16 Quarterly Earnings: What to Expect

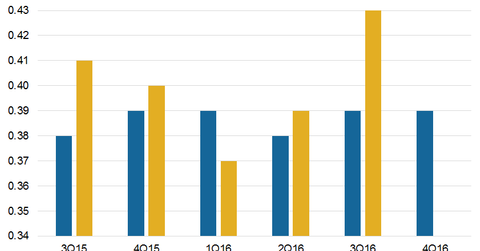

Ares Capital (ARCC) is expected to post EPS (earnings per share) of $0.39 in 4Q16, compared with $0.40 in 4Q15 and $0.43 in the previous quarter.

Feb. 14 2017, Published 4:51 p.m. ET

December quarter

Ares Capital (ARCC) is expected to post EPS (earnings per share) of $0.39 in 4Q16, compared with $0.40 in 4Q15 and $0.43 in the previous quarter. The company is expected to post revenue of $245 million, a 6.3% fall year-over-year, due to lower originations and interest income. In 3Q16, it beat the estimate of $0.39 and posted EPS of $0.43. Its net asset value stood at $5.2 billion, or $16.59 per share, on September 30, 2016, compared with $16.62 in the previous quarter. Ares Capital has also inked an agreement to acquire American Capital (ACAS). The combination of the two companies will create a middle-market lending giant.

Ares Capital’s portfolio investments at fair value stood at $8.8 billion on September 30, 2016, compared with $8.9 billion in the previous quarter. Ares Capital’s investment management competitors’ quarterly results were as follows:

- Blackstone Group (BX) beat estimates

- KKR & Co. (KKR) missed estimates

- Prospect Capital (PSEC) missed estimates

Together, these companies form 5.5% of the PowerShares Global Listed Private Equity ETF (PSP).

Closed-end asset manager

Ares Capital is a financial services company providing debt and equity funding solutions to US middle-market companies. The company originates and invests in secured loans, senior mezzanine debt, and equity investments through its direct origination platform.

Ares acts as a closed-end fund house and is regulated as a business development company. The company’s main objective is to generate both current income and capital appreciation through various investments. In the following parts of this series, we’ll study Ares Capital’s expected performance, yields, portfolio changes, capital deployment, dividends, American Capital acquisition, and valuation.