Another Robust Quarter by Vans Boosts VFC’s Fiscal 4Q16 Top Line

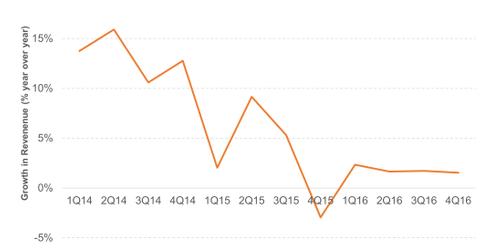

Revenues from VFC’s Outdoor and Action Sports segment rose 2% YoY to $2.1 billion, slightly below the company’s expectations.

Feb. 24 2017, Updated 7:37 a.m. ET

Evaluating the performance of VFC’s major segments

VF Corporation (VFC) operates its business through four major business segments: Outdoor and Action Sports, Jeanswear, Imagewear, and Sportswear. In this article, we’ll analyze the performance of the Outdoor and Action Sports segment, which is the company’s largest business. This segment accounted for 65% of VF Corporation’s top line in fiscal 4Q16.[1. quarter ended January 31, 2017]

Outdoor and Action Sports segment didn’t meet company expectations

Revenues from VFC’s Outdoor and Action Sports segment rose 2% YoY to $2.1 billion, slightly below the company’s expectations. This revenue increase was primarily due to the planned reduction in North Face shipments into the North America off-price channel.

VFC’s International and Direct-to-Customer (or D2C) channels gained momentum, growing at mid-teen rates through the quarter. Wholesale sales declined at a high single-digit rate as gains from its solid performance in the overseas markets were washed away by a mid-teen decline in sales in the Americas.

Competitor Ralph Lauren (RL), which reported its results in early February 2017, also posted a 26% YoY fall in quarterly wholesale revenues. This revenue decrease was driven by the strategic reduction in its North America shipments in an effort to reduce excess inventories and improve the quality of its sales.

Vans outshines Timberland and The North Face again

Vans became VF Corporation’s fastest-growing brand during 2016. Vans recorded stellar 15% growth during fiscal 4Q16, with D2C growing more than 20% and its Wholesale business recording single-digit rate growth. Its E-Commerce segment was even stronger and increased ~40% during the quarter.

Timberland also posted solid results, growing at a mid-double-digit rate. Growth was primarily driven by a low double-digit jump in D2C revenues and a low single-digit surge in its Wholesale business.

The North Face segment faced headwinds through the Wholesale channel, which was impacted by retail bankruptcies and inventory management decisions. While revenues in the Americas fell at a low double-digit rate, Europe posted another strong quarter, growing business at a high-teen rate.

Investors who want broad-based exposure to VFC can consider the First Trust Rising Dividend Achievers ETF (RDVY), which invests ~1.8% of its portfolio in VFC.