Will Macy’s Job Cuts and Store Closures Improve Its Position?

On January 4, Macy’s disclosed 68 store closures—three stores closed in mid-2016, 63 stores slated to close in early spring 2017, and two in mid-2017.

Jan. 9 2017, Updated 10:36 a.m. ET

Streamlining efforts

On January 4, Macy’s disappointed its investors with a dismal 2016 holiday sales report. The company also announced several restructuring and streamlining efforts to improve its performance. Aside from several restructuring initiatives, the company provided an update on its efforts to optimize its real estate portfolio. The company disclosed that since the end of fiscal 3Q16, it has sold its Stonestown store in San Francisco as well as its store in downtown Portland. The sale of these properties resulted in a gain of about $56 million. Macy’s also signed an agreement to sell its downtown Minneapolis store to 601W Companies. The sale is expected to close by the end of fiscal 2016.

Restructuring efforts

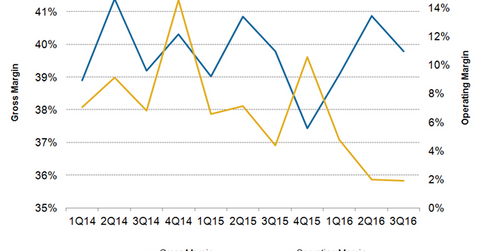

Macy’s margins have been under pressure due to lower sales and growth investments. The company’s operating margin fell in each of the first three quarters of fiscal 2016.

On January 4, the company disclosed 68 store closures—three stores closed in mid-2016, 63 stores slated to close in early spring 2017, and two in mid-2017. The store closures will result in a headcount reduction of 3,900 associates. The store closures are part of the company’s plan to close 100 stores previously announced in August 2016. Macy’s expects the closure of unproductive stores to enhance its margins in the long run.

The company discussed other measures to increase its efficiency, including removing layers of management to bring down costs and reducing non-payroll costs. These initiatives are expected to eliminate about 6,200 jobs.

Overall, the initiatives announced by Macy’s on January 4 are expected to generate annual expense savings of ~$550 million.

On January 4, Kohl’s (KSS) also indicated that its fiscal 2016 gross margin will likely be lower due to an unfavorable mix, the timing of the sales, and an intense promotional environment. Together, Macy’s and Kohl’s account for 0.5% of the iShares Global Consumer Discretionary ETF (RXI).

We’ll discuss analysts’ recommendations for Kohl’s and Macy’s in the next part of this series.