Why Does Comcast Expect Programming Costs to Rise in Fiscal 2016?

On March 8, 2016, the Wall Street Journal reported that Comcast and the YES Network were locked in a dispute regarding the carriage fee for the YES Network.

Dec. 4 2020, Updated 10:53 a.m. ET

Comcast’s carriage fee dispute with YES Network

On March 8, 2016, the Wall Street Journal reported that Comcast (CMCSA) and the YES (Yankees Entertainment and Sports) Network were locked in a dispute regarding the carriage fee for the YES Network. 21st Century Fox (FOXA) owns 80% of YES Network. It has launched a campaign asking its viewers to switch from Comcast to other pay-TV providers if they want to view baseball games this season.

The dispute has resulted in YES Network being blacked out for around 900,000 Comcast users in New Jersey and Connecticut since last year after the baseball season. According to the report, which cited SNL Kagan’s estimate, the carriage fee for YES is $5.36 per subscriber per month.

This dispute once again points to the tussle between pay-TV providers such as Dish Network (DISH) and channels regarding carriage fees as pay-TV providers such as Comcast try to rein in their programming costs.

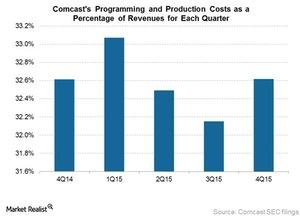

As the graph above shows, Comcast’s programming and production costs made up 32.6% of the company’s total revenues of $19.2 billion in 4Q15. Comcast had programming and production costs of $6.2 billion in 4Q15, a rise of 9% over 4Q14.

Comcast expects a rise in programming costs

Comcast’s CEO Brian L. Roberts acknowledged at a Morgan Stanley conference early this month that the company’s programming costs have been growing 7%–8% each year, higher than the rate of inflation, for the past couple of years.

Comcast expects programming costs to rise by about 10% in fiscal 2016 as a result of higher retransmission consent fees and the increased costs of sports programming. Comcast will also renew several of its programming deals in fiscal 2016.

Comcast makes up 2.9% of the PowerShares QQQ ETF (QQQ). QQQ has 4.7% exposure to the television and radio sector. QQQ also holds 5.4% of Amazon (AMZN).