RPM International Has Acquired Prime Resins

On January 17, 2017, RPM International (RPM) announced that it has acquired Prime Resins. The acquisition will be integrated into RPM’s USL Group.

Jan. 23 2017, Published 8:54 a.m. ET

RPM International continues its acquisition strategy

On January 17, 2017, RPM International (RPM) announced that it has acquired Prime Resins. RPM, whose vision is to achieve sales of $7.0 billion by 2020, sees the acquisition as one of its main strategies to achieve that target.

The acquisition will be integrated into RPM’s USL Group. RPM didn’t disclose the terms of the transaction, but the acquisition is expected to be included in its earnings within one year.

About Prime Resins

Prime Resins, headquartered in Conyers, Georgia, specializes in the manufacture of specialty chemicals and equipment for infrastructure construction and repair. Its product line includes polyurethane and epoxy grouts, foams, adhesives, and coatings used for leak-sealing, concrete structural repair, slab-lifting, and soil stabilization.

RPM stock

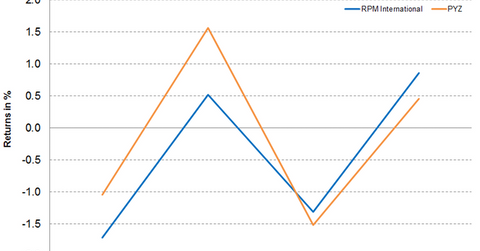

On January 20, 2017, RPM closed at $51.68, a fall of 1.7% for the week. The PowerShares DWA Basic Materials Momentum ETF (PYZ), which holds 2.7% in RPM as of January, fell 0.60% for the week and closed at $59.84.

RPM stock closed 0.40% lower than its 100-day moving average of $51.87. Analysts expect RPM’s 12-month target price to be $55.70, implying a potential return of 7.8% from the closing price on January 20, 2017.

You can hold RPM indirectly by investing in the PowerShares DWA Basic Materials Momentum ETF (PYZ). The top holdings of this fund include Chemours (CC), Cliffs Natural Resources (CLF), and Steel Dynamics (STLD), with weights of 3.9%, 3.8%, and 3.8%, respectively, as of January 20, 2017.