How Rate Hike Will Affect Banking Stocks

As the Federal Reserve begins to tighten the credit cycle, the potential impact on various equity sectors varies.

April 5 2017, Updated 1:36 p.m. ET

Direxion

Banks Win Yuuge

Certain sectors are closely correlated with the outlook for interest rates. Banking stocks tend to make money on the “net interest margin” between their liabilities (checking and savings accounts, CDs, etc) and their assets (mortgages issued, car loans, etc). It follows that margins rise with the general level of interest rates, so outperformance of the banking sector is usually a good bet. Banks have been outperforming since July. Some analyst think they’re on the verge of a big bullish breakout, as some traders are expecting an even more aggressive tightening timeline from the US central bank, than was previously anticipated.

Whether it’s U.S. Treasurys, miners, or bank stocks depending on the day, stocks may move “bigly”, in either direction. Daily leveraged and inverse ETFs magnify risk, volatility along with returns, so if you’re trading leveraged and inverse ETFs, make sure you monitor your positions.

Market Realist

Post-Trump victory, banking stocks outperformed the broader indexes

As the Federal Reserve begins to tighten the credit cycle, the potential impact on various equity sectors varies. The financial sector (FAS) is expected to get a leg up from the recent rate hike decision due to the widening of the net interest margin. Additionally, strong consumer and corporate balance sheets should support higher loan demand, benefiting the sector. The improving economy and rising wages also mean fewer bad loans, which helps strengthen the banks’ balance sheets. Additionally, the prospect of a lighter regulatory environment should help the financial sector (FAZ).

Against this background, the financial sector is thriving in the post-election scenario due to the prospect of higher economic growth, less regulation, and a steeper yield curve. The Fed’s latest rate hikes drew investors back to the financial sector, resulting in huge gains in the financials index. The MSCI USA IMI Financials Index is up 23.4% post-election to date compared to a 12.6% gain in the MSCI US Broad Market Index.

Leveraged ETFs

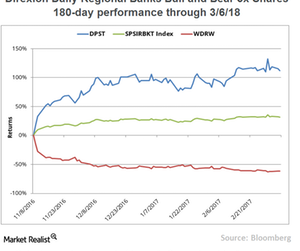

The Direxion Daily Regional Banks Bull 3x ETF (DPST) doubled after Trump’s victory. On the other hand, the Direxion Daily Regional Banks Bear 3x ETF (WDRW) plunged 60.6% during the same period. According to the fund, “The Direxion Daily Regional Banks Bull and Bear 3x Shares seeks daily investment results, before fees and expenses, of 300% or 300% of the inverse (or opposite) of the performance of the S&P Regional Banks Select Industry Index.” Though investors can multiply their returns through leveraged and inverse ETFs (NUGT), they should be used with utmost caution due to the complexity of the product.