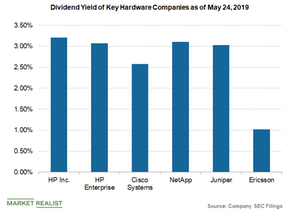

How HP’s Dividend Yield Stacks Up with Peers

HP (HPQ) generated free cash flow of $747 million in the second quarter of fiscal 2019, while cash flow from operations was $861 million.

May 29 2019, Published 2:08 p.m. ET

HP’s cash flows

HP (HPQ) generated free cash flow of $747 million in the second quarter of fiscal 2019, while cash flow from operations was $861 million. HP continues to expect fiscal 2019 free cash flow of at least $3.7 billion and plans to return approximately 75% of free cash flows to shareholders.

Share buybacks and dividends

HP has been increasingly rewarding its shareholders with dividend payments and share buybacks, owing to strong cash flows. HP returned 83% of its free cash flow to its shareholders via dividends and share buybacks in fiscal 2018, while the company returned 69% of the free cash flows to its shareholders in fiscal 2017. In the second quarter of fiscal 2019, HP returned over 100% of free cash flows to shareholders. During the second quarter, the company spent around $0.9 billion in cash to repurchase shares worth $691 million and for paying cash dividends of $245 million.

HP pays a cash dividend of $0.1602 per share in the second quarter, which comes to an annual dividend of $0.64 per share. HP has a dividend yield of 3.2% as of May 24, 2019, and a payout ratio of 31.7%.

HP has a higher dividend yield in comparison to its peers. The dividend yields of Hewlett Packard Enterprise (HPE), Juniper (JNPR), NetApp (NTAP), Cisco Systems (CSCO), and Ericsson (ERIC) stand at 3.07%, 3.02%, 3.10%, 2.57%, and 1.02%, respectively.