Apollo Investment’s Yields Stabilize, Reduced Exposure in Energy

At the end of fiscal 2Q17, Apollo Investment’s (AINV) oil and gas investments represented 9.7% of its total portfolio, or $246 million.

Jan. 2 2017, Updated 7:36 a.m. ET

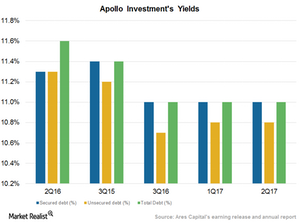

Stabilizing yields

Apollo Investment’s (AINV) yields have declined and stabilized at ~11%, on par with the average returns garnered by other closed-end funds. The company saw a yield of 11.0% in fiscal 2Q17 for the full portfolio. Its yields stood at 11.6% in fiscal 2Q16. Sequentially, the yields remained the same for both secured and unsecured debt.

Among Apollo Investment’s competitors, Ares Capital (ARCC) posted a yield of 9%, and Prospect Capital (PSEC) yielded more than 12%. Blackstone (BX) and KKR (KKR) generated double-digit returns on equity. Together, these companies form 6.0% of the PowerShares Global Listed Private Equity ETF (PSP).

Apollo Investment (AINV) has a preference for first lien and second lien investments in order to diversify and reduce its risks. The investments in structured offerings form just 10% of the total portfolio. The company is gradually adjusting its portfolio, with low double-digit return investments carrying lower risk.

AINV’s investments made in fiscal 2Q17 carry a yield of 10.3%, and the investments exited carry a yield of 10.7%. In fiscal 1Q17, these numbers stood at 10.8% and 10.5%, respectively.

Offloading riskier bets

At the end of fiscal 2Q17, Apollo Investment’s (AINV) oil and gas investments represented 9.7% of its total portfolio, or $246 million. This was down from 11.6%, or $304 million, in fiscal 1Q16 on a fair value basis. This decline was primarily due to the exit of investments from select companies. The company has major stakes in Canacol Energy Ltd. and Glacier Oil & Gas.

Over the past few quarters, Apollo Investment has considerably reduced its exposure to the energy sector. It has received more than $200 million in proceeds from the sale and repayment of its oil and gas investments.