Apollo Investments Sees Gains and Reversal on Portfolio

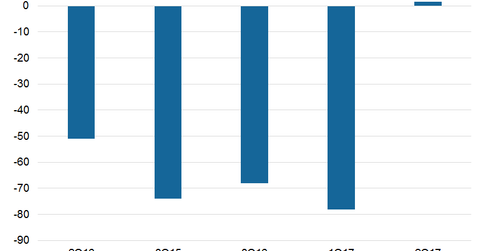

Apollo Investment’s (AINV) realized and unrealized gains stood at $1.6 million in fiscal 2Q17 compared to realized losses of $42.6 million in fiscal 1Q16.

Jan. 2 2017, Updated 9:06 a.m. ET

Reversal of trend

Apollo Investment’s (AINV) net investment income fell to $39.5 million in fiscal 2Q17 compared to $49.6 million in fiscal 2Q16. The decline was mostly due to net exits by the company over the past year in the wake of realized and unrealized losses, stemming mainly from investments in the energy space.

Apollo Investment’s (AINV) realized and unrealized gains stood at $1.6 million in fiscal 2Q17 compared to realized losses of $42.6 million in fiscal 1Q16. In the first half of fiscal 2017, the company’s unrealized losses stood at $76.6 million compared to $95.9 million in fiscal 1Q16.

The reduced losses indicate some recovery in asset pricing and improvement in interest income. However, the company has yet to see consistent performance with positive deployments in a bid to garner strong earnings.

Apollo Investment is closely monitoring its investments in the energy space and should seek to reduce its existing exposure whenever possible. Below is a look at how some of the firm’s competitors in the investment management field have performed in terms of return on equity:

Together, these companies form 4.7% of the PowerShares Global Listed Private Equity ETF (PSP).

Recapitalization

Apollo Investment (AINV) recently completed a recapitalization in order to provide liquidity and capital strength in the wake of higher losses on investments. On September 30, 2016, the company’s total outstanding debt stood at $1.0 billion, compared to $1.1 billion in the previous quarter.

Apollo Investment’s net leverage ratio, which includes the impact of cash and unsettled transactions, stood at 0.63x at the end of September 2016. This compares to 0.66x in the previous quarter.

Apollo Investment’s debt-to-equity ratio fell to 0.66x in fiscal 2Q17 compared to 0.75x in fiscal 2Q16, reflecting improvement in its capital structure.