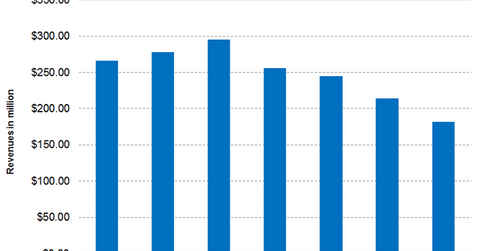

Why Did the Chemours Chemical Solutions Segment’s Revenue Dip in 3Q16?

Chemours’ Chemical Solutions segment reported revenue of $182 million in 3Q16, as compared to $295 million in 3Q15, implying a revenue fall of 38.2% YoY.

Nov. 10 2016, Updated 10:04 a.m. ET

Chemical Solutions’s 3Q16 revenue

Chemours’ (CC) Chemical Solutions segment reported revenue of $182 million in 3Q16, as compared to $295 million in 3Q15, which implies a revenue fall of 38.2% on a YoY (year-over-year) basis. The Chemical Solutions segment’s revenue represented ~13% of Chemours’ total revenues in 3Q16.

In 3Q16, the Chemical Solutions segment reported adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) of $9 million, as compared to $8 million in 3Q15, which implies a YoY rise of 12.5%.

Driving factors

This segment’s revenue fall in 3Q16 was primarily driven by the divestitures of the company’s Clean and Disinfect business and its Sulfur Products business to LANXESS and Veolia, respectively. Revenues also fell due to the impact of the Beaumont Aniline facility, which was sold to Dow Chemical (DOW) in March 2016.

These divestitures impacted the segment’s revenue negatively by 26%. The lower sales volume across segments had a negative impact of 5% on the segment’s revenue, while the low cost of raw materials pushed down prices, impacting revenue negatively by 7% YoY.

The segment’s adjusted EBITDA rose, however, due to cost-reduction measures and improvements in plant efficiencies.

Segment outlook

The impact of divestitures is expected to continue for the rest of the year. Chemours’ closed production facility in Niagara on September 28 will likely have a negative impact on the segment’s revenues, but on the positive side, Chemours expects the demand for sodium cyanide (used for gold production) to rise. To meet this demand, Chemours is looking for a new site and is expected to finalize the decision by the end of the year.

Notably, the PowerShares DWA Basic Materials Momentum Portfolio (PYZ) has 6.0% in Chemours. Other top holdings of PYZ include Ashland Global (ASH), International Paper (IP), and PPG Industries (PPG), which have weights of 5.6%, 5.1%, and 3.8%, respectively.

In the next and final part, we’ll analyze the analyst outlook for Chemours after its 3Q16 earnings.