Sprouts Farmers Market Beat Revenue Estimates in 3Q16

Sprouts Farmers Market (SFM) reported its 3Q16 results on November 3, 2016. The results relate to the three-month period ending October 2, 2016.

Nov. 4 2016, Published 11:10 a.m. ET

Series snapshot

Phoenix, Arizona-based Sprouts Farmers Market (SFM) reported its 3Q16 results on November 3, 2016. The results relate to the three-month period ending October 2, 2016.

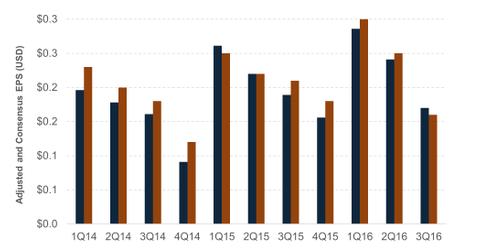

The company came in ahead of Wall Street analysts’ revenue estimates, but missed on the earnings. Its revenue rose 15% YoY (year-over-year) to $1 billion—$30 million more than the consensus forecast.

Its EPS (earnings per share) fell 24% to $0.16. It missed the consensus estimate by $0.01. It was the first time that the company witnessed a fall in earnings after being listed in July 2013.

Sprouts Farmers Market

Established in 2002, Sprouts Farmers Market operates as a value-oriented healthy grocery store. It offers fresh, natural, and organic food. The company operates 230 stores in 13 US states. It follows a small-box format with an average store size of 28,000–30,000 square feet. It’s about half the size of Whole Food (WFM) stores and one-third the size of Kroger’s (KR) combination stores.

Valuations overview

Currently, Sprouts Farmers Market trades at a one-year forward earnings multiple of 21.3x. It operates towards the lower end of its 52-week price-to-earnings range of 18.9x–27.7x.

The company continues to trade at a premium to supermarket chains Kroger, Whole Foods Market, and Supervalu (SVU). They’re valued at 14.5x, 19.5x, and 7.1x, respectively.

Investors looking to invest in Sprouts Farmers Market through ETFs can choose to invest in the iShares S&P Mid-Cap 400 Growth ETF (IJK). Sprouts Farmers Market accounts for ~0.44% of IJK.

This series

This series is an overview of Sprouts Farmers Market’s 3Q16 results. We’ll discuss the company’s financial performance during the quarter, key revenue drivers, stock market performance, target price, and current valuations.