Revenue Miss Was a Hallmark of Steel Companies’ 3Q16 Earnings

One of the key features of steel companies’ 3Q16 financial performance was lower-than-expected revenues.

Nov. 16 2016, Updated 1:04 p.m. ET

Revenue miss

One of the key features of steel companies’ 3Q16 financial performances was lower-than-expected revenues. With the exception of Steel Dynamics, all the steel companies in our coverage missed consensus revenue estimates in 3Q16 as well as 2Q16.

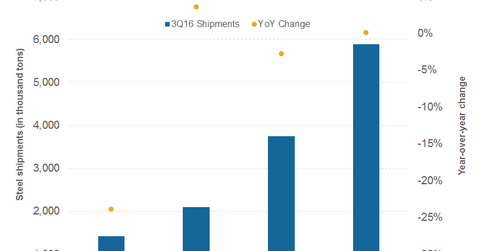

It’s worth noting that steel companies’ (XME) revenues are a function of shipments and average selling prices. Let’s take a look at the 3Q16 shipments for the steel companies we’re covering.

3Q16 steel shipments

- ArcelorMittal (MT), the world’s leading steelmaker, shipped 20.3 million tons of steel to outside customers in 3Q16. Its steel shipments fell 3.6% compared to 3Q15. Shipments fell ~8.0% compared to the sequential quarter.

- United States Steel’s (X) shipments totaled 3.7 million tons in 3Q16. They fell 2.8% on a yearly basis and 3.7% on a sequential basis.

- Nucor’s (NUE) 3Q16 steel shipments were similar to 3Q15.

- Steel Dynamics’ (STLD) 3Q16 steel shipments rose 3.6% on a yearly basis to 2.1 million tons. It reported the highest yearly increase in steel shipments among the companies that we’re covering.

AK Steel’s shipments fell the most

AK Steel’s (AKS) 3Q16 steel shipments fell 24.0% on a year-over-year basis to 1.4 million tons. They’ve fallen steeply over the last few quarters after the company deliberately cut its exposure to spot commodity-grade products.

While lower spot exposure has negatively impacted shipments, it has had a positive impact on AK Steel’s average selling price. We’ll look at this more in the next part of this series.