The Outlook for Disney Consumer Products and Interactive Media

The Walt Disney Company (DIS) stated in its fiscal 4Q16 earnings call that in fiscal 1Q17, it expects operating income for Disney Consumer Products and Interactive Media to fall.

Nov. 24 2016, Updated 11:04 a.m. ET

Disney Consumer Products and Interactive Media

The Walt Disney Company (DIS) stated in its fiscal 4Q16 earnings call that in fiscal 1Q17, it expects operating income for Disney Consumer Products and Interactive Media to fall year-over-year about 20.0%. The fall is due to a difficult comparison in licensing its Star Wars and Frozen merchandise and licensing its Star Wars Battlefront game in fiscal 1Q16.

Disney’s consumer products business has benefited from the acquisitions of Marvel, Lucasfilm, and Pixar. Disney has always maintained that a core part of its business strategy is effectively monetizing its intellectual property. Its acquisitions have further added to its intellectual property portfolio.

At the MoffettNathanson Media & Communications Summit this year, the company stated that monetizing its intellectual property created through the Marvel and Lucasfilm acquisitions contributed to the growth of its Consumer Products business.

The company also stated in its fiscal 4Q16 earnings call that 11 of its franchises from the Consumer Products business had sales of more than $1.0 billion globally in fiscal 2015. The company further stated that considering the rise in sales from its franchises, it expects its Consumer Products and Interactive business to turn profitable.

Segment revenues

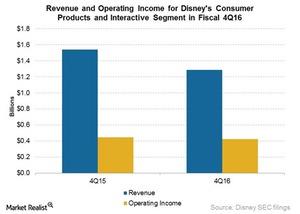

In fiscal 4Q16, Disney Consumer Products and Interactive Media had revenues of $1.3 billion, a fall of 17.0% year-over-year. The segment had an operating income of $424.0 million, which was a fall of 5.0% year-over-year. The fall was mainly due to the discontinuation of Disney’s Infinity console games. A fall in merchandise licensing and games also resulted in a fall in operating income for this segment.