A Closer Look at Cisco’s Fundamentals

In fiscal 2016, Cisco (CSCO) reported revenues of $49.2 billion. Product revenue came in at $37.2 billion while services revenue reached $12 billion.

Nov. 4 2016, Updated 8:04 a.m. ET

Revenue in 2016

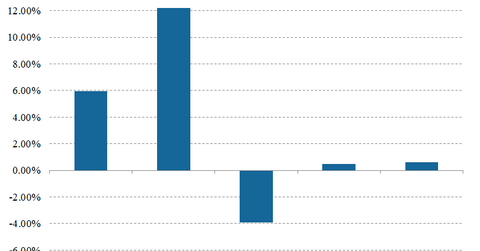

In fiscal 2016, Cisco Systems (CSCO) reported revenues of $49.2 billion. Product revenue came in at $37.2 billion while services revenue reached $12 billion. By comparison, Cisco’s revenue in fiscal 2014 and fiscal 2015 were $47.1 billion and $49.2 billion, respectively. Excluding the divestiture of its set-top business, its revenues grew 3% YoY (year-over-year) in fiscal 2016.

Cisco’s deferred revenue rose 8% YoY to $16.5 billion in 2016, while recurring product deferred (primarily in Cisco’s software and subscription business) revenue rose 33% YoY.

Notably, Cisco’s annual report stated: “This shift is particularly evident in our Security portfolio—close to 50% of which we now deliver through software or as a service—and our Collaboration portfolio, all of which we are committed to delivering from the cloud. We are working to move more of our revenue to a software based and subscription-based model and to accelerate this shift across our entire product portfolio.”

Focus on improving profitability

Cisco had previously stated that it needs to focus on improving operational efficiency to improve profit margins. In fiscal 2016, its net income rose 20% YoY to $10.7 billion, while EPS (earnings per share) rose 21% YoY to ~$2.1 billion.

Balance sheet and share buybacks

Cisco’s total assets rose 7% YoY to $121.7 billion in fiscal 2016. Cisco’s cash, cash equivalents, and investments amounted to $65.8 billion, and the firm generated $13.6 billion in operating cash flow as well.

Meanwhile, Cisco returned $8.7 billion to shareholders in fiscal 2016. Share buybacks totaled $3.9 billion, and dividends came to $4.8 billion in fiscal 2016. Cisco has made it clear that it will “remain firmly committed to returning a minimum of 50% of our free cash flow to shareholders annually.”

In the next and final part, we’ll check in with analyst recommendations.