KKR Maintains Dividends, Continues with Repurchases in 3Q

As of October 2016, KKR has bought back 31.5 million common units for $457 million of its announced $500 million share repurchase program in December 2015.

Nov. 24 2016, Updated 11:04 a.m. ET

Dividend yields

KKR & Company (KKR) rewards its shareholders through share dividends and repurchases. As of October 2016, the company bought back 31.5 million common units for $457 million of its announced $500 million share repurchase program in December 2015.

In addition, 5.2 million granted equity awards valued at $79 million were canceled to satisfy tax obligations in connection with vesting. In total, 36.7 million common units have been retired on a fully diluted basis since October 2015.

KKR continues with its fixed dividend policy of $0.16 per common share. Prior to the current dividend policy, the company distributed 75%–80% of its distributable earnings at an annualized yield of ~8%.

The company intends to retain more cash on its balance sheet by offering fixed and lower dividends. The current dividend yield stands at 4%.

New policy augments cash levels

KKR intends to generate a higher return on retained cash by investing in profitable opportunities and leveraging on its scale of resources. The company’s employees and senior management hold ~45% of the company’s shares. With a balance sheet of $13.5 billion on September 30, 2016, its annualized distribution yield now stands at 4%.

KKR’s competitors have the following returns on equity:

Together, these companies make up 4.3% of the PowerShares Global Listed Private Equity ETF (PSP).

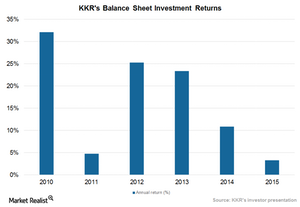

KKR has managed to generate a compound annual return of 13% on its book value over the past six years, reflecting a higher than opportunity rate of return. The company believes that it can provide a better return to its investors than they can generate themselves. The company can also deploy more resources toward its buyback program as it believes the stock to be undervalued at current levels.

Continue to the next and final part of this series for a look at KKR’s evaluations.