E*TRADE Bank Saw Continued Expansion, Supported Broking

E*TRADE’s bank offers its clients FDIC insurance on a certain amount of deposits. It deploys funds primarily in low-risk securities.

Nov. 21 2016, Updated 5:04 p.m. ET

Bank’s rapid expansion

E*TRADE Financial (ETFC) operates the federally chartered savings bank called “E*TRADE Bank.” The broking and banking model has been deployed by major brokers in the US. It helped garner assets and generate interest revenues. E*TRADE’s bank offers its clients FDIC (Federal Deposit Insurance Corporation) insurance on a certain amount of deposits. The bank deploys funds primarily in low-risk securities such as agency mortgages.

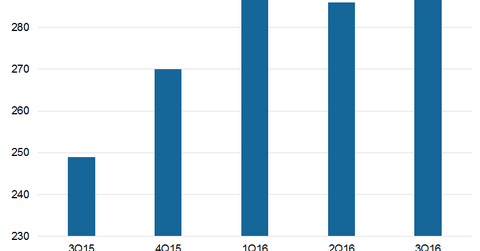

On an individual basis, the bank generated net interest income of $287 million in 3Q16—compared to $249 million in 3Q15. The bank’s net interest margins could rise due to an expected increase in interest rates by the Fed in the last quarter of 2016.

Here’s how a few of the company’s competitors in the industry performed in terms of operating margins:

- TD Ameritrade Holding (AMTD) – 41.1%.

- Charles Schwab (SCHW) – 34.4%.

- Interactive Brokers Group (IBKR) – 45.4%.

Together, these companies account for 16.5% of the iShares US Broker-Dealers ETF (IAI).

Strong balance sheet

As of September 30, 2016, E*TRADE, under the Basel III Standardized Approach, reported bank and consolidated Tier 1 leverage ratios of 7.3% and 8.5%, respectively. In the previous quarter, the company reported bank and consolidated Tier 1 leverage ratios of 7.5% and 8.2%, respectively. The ratios reflected strong risk management and nominal leverage on its balance sheet.

Corporate cash ended the second quarter at $306 million—41% higher than the prior quarter and well above the company’s target of $100 million. The fall was mainly due to a deployment of reserves towards the OptionsHouse acquisition.

Gradually, E*TRADE wants to move clients from other banks to its own bank by marketing efficiency and ease of trade. The company is also using its sweep platform for moving deposits on and off of its balance sheet at a quicker pace. E*TRADE aims for a deposit base of $50 billion under its existing structure.