How Did Cisco’s Wireless Segment Perform in Fiscal 1Q17?

Cisco’s (CSCO) wireless business’s revenues fell 2% YoY (year-over-year) in fiscal 1Q17.

Nov. 23 2016, Updated 10:04 a.m. ET

Revenues fell 2% YoY

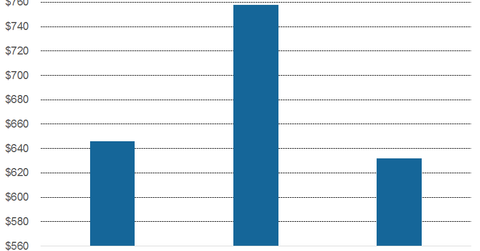

Cisco’s (CSCO) wireless business revenues fell 2% YoY (year-over-year) in fiscal 1Q17. Revenues in this segment fell from $646 million in fiscal 1Q16 to $632 million in fiscal 1Q17 driven by “a decline in controllers and soft E-rate funding partially offset by strong growth in Meraki with our cloud managed product line.” A wireless local area network uses radio waves to connect devices such as laptops and smartphones to the Internet.

Wireless LAN market grew in 2Q16

According to IDC, the total WLAN (wireless local area network) market rose 6.7% YoY (year-over-year) and 6.7% on a sequential basis (quarter-over-quarter) in 2Q16. The Enterprise WLAN market rose 9.4% YoY in 2Q16.

At the end of 2Q16, Cisco Systems’ (CSCO) WLAN revenue rose 1.1% YoY, and its market share was 43.7% as compared to 45.2% in 1Q16 and 47.3% in 2Q15. Cisco’s acquisition of Meraki is one of the key revenue and growth drivers for the firm.

Hewlett Packard Enterprise (HPE) is another major player in this market with a share of 14.6% in 2Q16 as compared to 15.8% in 1Q16 and 17.1% in 2Q15. Brocade (BRCD)-Ruckus’s (RKUS) revenues grew 7.9% YoY, but its market share fell to 6.8% in 2Q16 from 7.7% in 1Q16 and 6.9% in 2Q15.

Tech (QQQ) stocks such as Ubiquiti’s and Aerohive’s revenues also rose significantly YoY in 2Q16 by 95.3% and 34.1%, respectively. While Ubiquiti accounted for 4.2% of the overall market in 2Q16, Aerohive accounted for 2.7%.