Ares Capital Second Lien Preference Evident in Portfolio Changes

Ares Capital (ARCC) has consistently enhanced its exposure to second lien debt in a bid to generate higher yields.

Nov. 18 2016, Updated 10:04 a.m. ET

Second lien preference

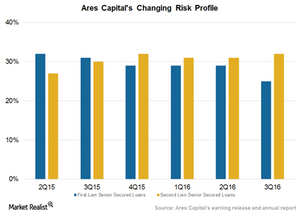

Ares Capital (ARCC) has consistently enhanced its exposure to second lien debt in a bid to generate higher yields. In 3Q16, second lien debt made up 23% of its new commitments as against exits of 18%. The second lien portfolio represents 32% of the company’s total portfolio. First lien senior secured loans represent 25% compared to 29% in the previous quarter.

The company’s exposure to first lien loans has fallen consistently from 34% in 1Q15 to 25% in 3Q16. The company is targeting a minimum of 400 basis points higher than what it generates on first lien senior loans.

Ares Capital’s altered portfolio strategy should help it boost the yield on its overall portfolio. The company’s overall risk profile has deteriorated due to these changes. However, it remains competitive when compared with the industry averages. The management believes that a careful selection of companies for investments can help it reduce the risk arising from investment in a second lien over a first lien.

Ares Capital has generated a return of 7.2% on its equity. Here’s how some of the firm’s peers in investment management have performed in terms of return on equity:

Together, these companies form 6.0% of the PowerShares Global Listed Private Equity ETF (PSP).

Q4 net exits

In October 2016, Ares Capital made new investment commitments of approximately $73 million, of which $67 million were funded. Of these new commitments, 71% were made in investments in SDLP (Senior Direct Lending Program) certificates. About 29% were in first lien senior secured loans. The weighted average yield of debt and other income-producing securities funded during the period at amortized cost was 9.7%.

The company also exited ~$182 million of investment commitments in October 2016. The weighted average yield of debt and other income-producing securities exited or repaid during the period at amortized cost was 9.6%.