Ares Capital Enhances Originations in 3Q16

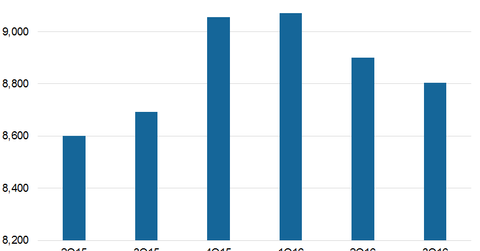

By the end of September 2016, Ares Capital (ARCC) had a diversified portfolio of 215 companies totaling $8.8 billion at fair value.

Nov. 17 2016, Updated 7:04 p.m. ET

Rebuilding portfolio

By the end of September 2016, Ares Capital (ARCC) had a diversified portfolio of 215 companies totaling $8.8 billion at fair value. The company made a total of $1,529 million in new investment commitments in 3Q16 and total exits of $1,499 million, reflecting net investments.

Based on the initial investment amount, Ares Capital’s weighted average yield stood at 8.7% compared to 9.1% as of December 31, 2015, and 9.4% as of September 30, 2015. The yield on debt and other income-producing securities stood at 9.8%. The company’s yields fell mainly due to lower yields on subordinated certificates in SSLP (Senior Secured Loan Program) and lesser transaction flows in high-yield markets. Ares Capital intends to sell these deployments to SDLP (Senior Direct Lending Program) on the construction of a diversified portfolio for the program.

Net investments

Ares Capital’s exits in terms of repayment, selling, or other amounted to $1,499 million during 3Q16. Of these investment exits, 77% were first lien senior secured loans, 18% were second lien senior secured loans, 4% were senior subordinated debt, and 1% were Senior Secured Loan Program. Of the investment commitments received, 52% were in first lien senior secured loans, 23% were in second lien senior secured loans, 15% were in subordinated certificates of the SDLP, 7% were in senior subordinated debt, 2% were in preferred equity securities, and 1% were in other equity securities.

Ares Capital continues to deploy funds in second lien loans to either known or large companies in order to generate better yields.

Here are some of the company’s peers in investment management and their assets under management:

- Carlyle Group (CG): $194 billion

- KKR (KKR): $98 billion

- Apollo Global Management (APO): $189 billion

Together, these companies form 5.1% of the PowerShares Global Listed Private Equity ETF (PSP).

Ares Capital leverages its size and scale of operations. The company made 14 of 26 investments in existing portfolio companies in 3Q16. The strong existing relationships with various clients enables the company to continue providing them with funding support as they grow or change ownership. This does lead to some portfolio concentration. However, it allows the company to grow with its strongest portfolio companies and avoid some aggressive transactions. As of September 30, 2016, 148 separate private equity sponsors were represented in Ares Capital’s portfolio.