ITMS: Taking a Very Narrow View of the Municipal Yield Curve

As of September 30, 2016, ITMS has all of its investments in US dollar-denominated bonds with a credit rating of “A” or higher, thus ensuring lower risks.

Oct. 13 2016, Updated 3:04 p.m. ET

Market Realist – The VanEck Vectors AMT-Free 6-8 Year Municipal ETF

The VanEck Vectors AMT-Free 6-8 Year Municipal ETF (ITMS) is designed to imitate the price and yield performance of the Bloomberg Barclays AMT-Free 6-8 Year Intermediate Continuous Municipal Index. The index, which includes investment-grade municipal bonds with a maturity of six to eight years, tracks the overall performance of the US dollar-denominated intermediate term tax-exempt bond market (HYD) (SMB).

As of September 30, 2016, ITMS has all of its investments in US dollar-denominated bonds with a credit rating of “A” or higher, thus ensuring lower risk. ITMS is positioned as a subset of the VanEck Vectors AMT-Free Intermediate Municipal ETF (ITM).

State and sector breakdown

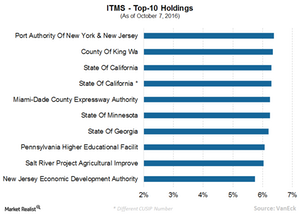

ITMS has a major exposure in New York, California, Pennsylvania, Washington, and Florida, which together account for 57.4% of ITMS’s total portfolio as of September 30, 2016. The sector breakdown for ITMS includes large weights in sectors related to state (29.6%), local (20.4%), transportation (17.1%), and education (11.7%) as of September 30, 2016.

ITMS has an effective duration of 6.0 years as of October 7, 2016. Duration shows a bond fund’s sensitivity to changes in interest rates. For instance, a 1.0% rise in rates would lead to about a 6.0% fall in the bond fund’s price. With a comparatively shorter duration, ITMS is best suited for investors who expect interest rates to increase in the near term. These investors normally try to avoid being trapped in a bond that pays a lower rate once interest rates rise.

In the next part of the series, we’ll take a look at the VanEck Vectors AMT-Free 12-17 Year Municipal ETF (ITML).