ITML: Taking a Less Conservative View of the Marketplace

With a longer duration of the intermediate bonds rate curve, ITML is best suited for investors who are uncertain about the movement of interest rates in the near future.

Oct. 14 2016, Updated 1:02 p.m. ET

JIM COLBY: ITML (VanEck Vectors AMT-Free 12-17 Year Municipal Index ETF), also positioned as a subset of the broader ITM, is going to be associated with bonds from 12 to 17 years, which is the longer end of the bond maturity range for the broader ITM ETF. It is designed for those individuals who are willing to take a slightly more aggressive view of the marketplace and willing to take a little bit more interest rate risk with an intermediate position.

Market Realist – The VanEck Vectors AMT-Free 12-17 Year Municipal ETF

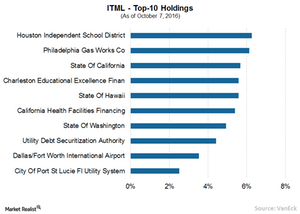

The VanEck Vectors AMT-Free 12-17 Year Municipal ETF (ITML) aims to imitate the Bloomberg Barclays AMT-Free 12-17 Year Intermediate Continuous Municipal Index. ITML invests in US dollar-denominated bonds with a credit rating of Baa3/BBB- or higher.

State and sector breakdown

ITML is heavily tilted toward municipal debts in California, Texas, New York, Florida, and Pennsylvania. Together, they make up 55.1% of ITML’s total portfolio as of September 30, 2016.

The sector breakdowns include large weights in sectors related to state (24.6%), special tax (12.9%), local (12.6%), water and sewer (12.4%), and leasing (9.9%) as of September 30, 2016.

Tax benefits and expense ratios

Municipal bonds (HYD) (SMB) income is generally exempt from federal and state taxes. This applies to ITML and ITMS. Both of them have expense ratios of 0.24%.

Longer Duration

ITML has an effective duration of 7.5 years as of October 6, 2016. The VanEck Vectors AMT-Free Intermediate Municipal ETF (ITM) has an effective duration between ITMS’s and ITML’s at 6.6 years.

With a longer duration of the intermediate bonds rate curve, ITML is best suited for investors who are uncertain about the movement of interest rates in the near future. These investors are taking a bit of an aggressive stance with the rate curve compared to ITMS investors.

In the next part of the series, we’ll see how to take advantage of intermediate-term municipal bonds.