Intermediate-Term Municipal Bonds Are in a Sweet Spot

Immediate-term bonds (ITM) are better placed since investors take less of an interest rate risk.

Oct. 14 2016, Updated 8:04 a.m. ET

JIM COLBY: Why have we brought these two new municipal bond ETFs to market?

The municipal yield curve, particularly along the intermediate range, is changeable, depending on market conditions. We want to offer investors more focused opportunities that tactically facilitate total return potential ― given that it might occur in the short end of the market, or it might occur in the long end of the intermediate yield curve. These two new ETFs focuses on two specific slices of the muni yield curve, and represent tactical opportunities for investors to create more dynamic portfolios. Employing one or the other, or perhaps both, in some combination in investors’ portfolios, is the very thing that we had in mind.

Market Realist – Availability of more focused opportunities

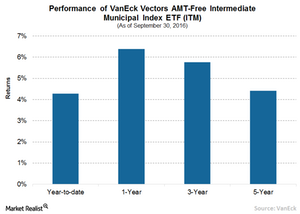

Long-term bonds with a maturity of more than 20 years often have better interest rates than short-term and intermediate-term bonds due to higher risk. Short-term bonds (SMB) with a maturity of one to five years offer lower returns due to a lower interest rate risk. Immediate-term bonds (ITM) are better placed since investors take less of an interest rate risk than long-term bonds and still get a better rate than short-term bonds.

Rationale behind VanEck’s new ETFs

James Colby, portfolio manager for VanEck, explained the rationale behind the introduction of the two new ETFs. He said, “Historically, the intermediate portion of the curve has been a ‘sweet spot’ in munis, having offered one of the greatest potential to gain incremental returns as investments move from longer maturities to shorter maturities, also known as rolling down the yield curve. ITM, and now ITML and ITMS, provide targeted ways for investors to potentially capture that opportunity in highly refined ways.”

Rolling down the yield curve is a strategy that involves selling longer-dated bonds before maturity in order to profit from a price rise. This strategy can provide higher returns as long as the yield curve is normal.

During shaky times with lower rates and uncertainty over future interest rate hikes, intermediate-term municipal bonds (ITMS) (ITML) represent more focused opportunities for investors seeking higher yields (HYD).